Down payment assistance program texas income requirements Quiz

Test Your Knowledge

Question of

Understanding Down Payment Assistance Programs in Texas

Eligibility Criteria for Applicants

Texas offers a variety of down payment assistance programs to make homeownership accessible. To qualify, applicants must meet certain criteria that typically include income, asset, and credit requirements. These programs aim to help first-time homebuyers or those who haven't owned a home in the past three years.

Income Thresholds: Eligibility often hinges on household income relative to the area median income (AMI). Programs are designed to cater to low-to-moderate-income families, ensuring that assistance goes to those who need it most. Income limits can vary based on family size and the county of the prospective property.

Asset Limits: Some programs set limits on the amount of liquid assets an applicant can hold. This ensures that funds are directed towards individuals who do not have substantial savings to cover a down payment. The definition of assets can include checking and savings accounts, stocks, bonds, and other forms of liquid capital.

Credit Score Requirements: A minimum credit score is often required to qualify for assistance. This criterion demonstrates financial responsibility and creditworthiness. Some programs also offer educational courses to help applicants improve their credit scores before applying.

Types of Down Payment Assistance

The state of Texas provides several types of down payment assistance options, tailored to fit various financial situations. These offerings include grants, loans with favorable terms, and more. Each program has its unique features and benefits designed to make homeownership more attainable for Texans.

Grants and Forgivable Loans: Grants are essentially free money given to assist with the down payment and do not require repayment if certain conditions are met. Forgivable loans may be converted into grants if the homeowner meets specific terms, such as residing in the home for a pre-defined period.

- Deferred Payment Loans: These loans typically require no monthly payments and are only repaid when the homeowner sells, refinances, or pays off their first mortgage. This helps reduce the initial financial burden on buyers.

- Low-Interest Loans: For those who don't qualify for grants or deferred loans, low-interest loans provide an affordable alternative. They offer reduced interest rates compared to market rates, making monthly mortgage payments more manageable.

Navigating Income Requirements for Texas Programs

Determining Your Income Eligibility

Figuring out if you qualify for various Texas assistance programs starts with understanding your income eligibility. It's a critical first step, as many programs have strict income thresholds. To start, you'll need to gather your financial information, including wages, benefits, and any other sources of income.

Once you've tallied up your income, compare it against the eligibility criteria for the specific program you're interested in. These criteria are often available on the program's website or through contacting their customer service. Keep in mind that some programs adjust their income limits annually based on factors like inflation or changes in median income levels.

Calculating Household Income

To accurately calculate your household income, include all earnings from each person living in your home who contributes financially. This encompasses salaries, hourly wages, tips, business income, and any government or private assistance. Don't overlook occasional or seasonal income every dollar counts towards determining eligibility.

The complexity of calculating household income means its easy to make mistakes. Heres a list of common pitfalls to avoid:

- Underreporting Income: Ensure that you report all sources of income for every household member to avoid issues with eligibility or legal consequences.

- Forgetting Seasonal Work: Seasonal jobs can significantly affect your annual income calculations; remember to include these earnings.

- Ignoring Non-Cash Benefits: Some non-cash benefits may count as income, so check program guidelines carefully.

- Omitting Interest and Dividends: Investment returns can impact your household income; include all interest and dividends received throughout the year.

- Miscalculating Self-Employment Earnings: Self-employed individuals should take care to accurately report net income after business expenses.

Adjusted Gross Income vs. Total Household Income

Your Adjusted Gross Income (AGI) is what's left after deductions from your gross income on your tax return. Its a key figure used by many Texas programs to determine eligibility. AGI includes wages, dividends, alimony, capital gains, and retirement distributions minus specific deductions like student loan interest or contributions to retirement accounts.

In contrast, total household income is broader and includes more sources of revenue. Besides your AGI components, it also factors in untaxed foreign income, certain social security benefits not included in AGI, and non-taxable portions of IRA contributions. Understanding the differences ensures accurate reporting for assistance programs.

Documentation Needed for Verification

To verify your income for Texas assistance programs, be prepared with documentation such as recent pay stubs, tax returns from the previous year, or statements from Social Security or other benefit providers. Accurate records are necessary to prove eligibility and determine the level of assistance you may receive.

If self-employed or freelancing, maintain detailed financial records including invoices and receipts. This documentation will help establish a clear picture of your earnings when applying for state aid programs. Inaccuracies can lead to delays or denials of assistance.

Impact of Income on Assistance Amount

The amount of assistance you're eligible for in Texas often operates on a sliding scale based on your income level. As such, lower-income households typically qualify for more substantial aid compared to those nearer the upper-income limits of program eligibility thresholds.

Sliding Scale Benefits

Texas programs use sliding scales to ensure fair distribution of funds and help those most in need. If you fall into a lower-income bracket according to their scales, you might receive higher benefits which gradually reduce as your earnings increase towards the maximum allowable limit for the program.

Maximum Assistance Caps

All assistance programs have caps maximum amounts that they will not exceed regardless of how low an applicant's income is. These caps ensure that no individual receives more than what is deemed necessary according to state guidelines and budget allocations.

Average Assistance Based on Income Levels

The average assistance provided often correlates directly with various established income levels within the states framework. Understanding this correlation can help set realistic expectations about the amount of aid one might receive when applying for different Texas assistance programs based on their respective guidelines.

Exploring State-Sponsored Assistance Options

Embarking on the journey to homeownership can be exhilarating, yet daunting. In Texas, state-sponsored assistance programs are a beacon of hope for prospective homebuyers. These initiatives are designed to provide financial aid and educational resources, making the dream of owning a home an attainable reality for many.

State assistance programs often come with a variety of options, each tailored to fit different needs. They can range from down payment assistance to tax credits, all crafted to ease the financial burden on homebuyers. Understanding and utilizing these programs can be a game-changer, propelling you toward securing your new home.

Texas State Affordable Housing Corporation (TSAHC) Programs

Homes for Texas Heroes Program

The Homes for Texas Heroes Program is an incredible opportunity for those who serve our communities. Designed specifically for teachers, firefighters, EMS personnel, police, correctional officers, and veterans, it offers unparalleled mortgage interest rates and down payment assistance grants. This program is a salute to our heroes, providing them with the support they deserve.

Home Sweet Texas Home Loan Program

The Home Sweet Texas Home Loan Program stands as a testament to the state's commitment to its residents' housing needs. Catering to low and moderate-income families, it offers competitive interest rates and down payment assistance that make homeownership more accessible. It's a cornerstone program that reflects Texas's hospitable spirit.

First-Time Homebuyer Programs

For first-time homebuyers in Texas, there's a light at the end of the tunnel with TSAHCs first-time homebuyer programs. These programs lower barriers by offering mortgage loans with fixed interest rates and down payment assistancetruly a lifeline for those entering the housing market for the first time.

Texas Department of Housing and Community Affairs (TDHCA) Offerings

My First Texas Home Program

The My First Texas Home Program shines brightly as an initiative that champions accessibility. Providing 30-year fixed-rate mortgage loans and down payment assistance up to 5% of the loan amount, it paves the way for first-time buyers' success stories. This program embodies TDHCAs dedication to transforming lives through homeownership.

Texas Mortgage Credit Certificate Program

A beacon of hope for budget-conscious homebuyers is the Texas Mortgage Credit Certificate Program. This innovative program allows buyers to claim a tax credit for a portion of their mortgage interest paid annuallya substantial financial reprieve that can open doors and alleviate long-term financial pressure.

Homebuyer Education and Counseling

- Educational Workshops: TDHCA provides comprehensive workshops covering all aspects of buying a homeessential knowledge that empowers buyers throughout their journey.

- Counseling Services: Free or low-cost counseling services offer personalized guidance to help individuals navigate the complex process of homeownership.

- Financial Fitness: Gain insights into managing personal finances effectively with targeted sessions on budgeting and credit managementcrucial skills for any homeowner.

- Ongoing Support: TDHCAs commitment extends beyond initial education; ongoing support ensures homebuyers are well-equipped to handle future housing-related challenges.

In conclusion, both TSAHC and TDHCA offerings are vital resources that should be thoroughly explored by potential homeowners in Texas. The combination of financial aid and educational programs they provide creates a robust framework that supports sustainable homeownershipa true testament to Texas's investment in its communities' growth and prosperity.

Local Down Payment Assistance Programs in Texas

City-Specific Programs and Requirements

The Lone Star State is brimming with opportunities for prospective homeowners, especially through localized down payment assistance programs. Each program is tailored to the citys unique housing market and resident needs. Qualifications often hinge on factors like income level, property location, and first-time homebuyer status.

Houston Homebuyer Assistance Program : Houston is offering a golden ticket for those dreaming of homeownership! The program not only provides financial aid for down payments but also helps with closing costs. Eligibility criteria include income limits and mandatory homebuyer education courses.

Dallas Homebuyer Assistance Program : Dallas residents, get ready to turn your home-owning dreams into reality! This program serves up generous assistance, requiring applicants to meet certain income thresholds and participate in homebuyer education sessions.

San Antonio Homeownership Incentive Program : San Antonio is rolling out the red carpet for future homeowners with its attractive incentives. Prospective buyers can receive up to $12,000 in assistance, provided they adhere to the program's guidelines which include property bounds within city limits.

County Initiatives for Homebuyers

Counties across Texas are stepping up their game with down payment assistance programs designed to foster community growth and homeownership. These initiatives typically revolve around helping low-to-moderate-income families secure a slice of the American Dream.

Harris County Down Payment Assistance : Harris County isn't just about urban sprawl; it's also about making homes affordable! The county's program offers up to $23,800 in assistance for eligible buyers, focusing on bolstering economic diversity within its communities.

Travis County Housing Finance Corporation Programs : Travis County offers a beacon of hope for those feeling priced out of Austin's competitive housing market. The countys programs are designed to assist residents with closing costs and down payments, easing the path towards homeownership.

- Bexar County Homeownership Incentive Program : Bexar County is empowering its residents with financial aid that doesn't stop at down paymentsit also covers some closing costs! To qualify, applicants must meet income criteria and purchase within certain areas.

- Always ensure you meet all eligibility requirements before applying for any program.

- Don't overlook the importance of mandatory homebuyer education courses; they're often required for assistance eligibility.

- Beware of the deadlines; submit your application well before due dates to avoid missing out on available funds.

- Maintain a good credit score as it may influence your qualification status for certain programs.

- Remember that some programs may require you to reside in the property as your primary residence for a specified period.

Special Considerations for Various Demographics

Programs for First-Time Homebuyers

First-time homebuyers have unique opportunities to own their dream homes through specialized programs. These initiatives offer financial benefits like lower down payments and attractive mortgage rates. It's crucial for newcomers to understand the ropes of these programs to fully capitalize on the available advantages.

Definition of a First-Time Homebuyer in Texas: In Texas, a first-time homebuyer is typically someone who has not owned a primary residence in the past three years. This definition opens doors to various state and federal incentives designed to make homeownership more accessible and affordable.

Exclusive Programs and Benefits: Texas offers several exclusive programs for first-time buyers, including down payment assistance and tax credits. These programs are tailored to help reduce the upfront costs of purchasing a home, making it more feasible for first-time buyers to enter the housing market.

Combining with Other Financial Assistance: First-time buyers shouldn't stop at one program. Many can combine multiple financial aids, such as local grants or employer assistance, to stack benefits. Strategic combination can lead to substantial savings, making the dream of homeownership a tangible reality.

Support for Veterans and Service Members

Veterans and service members are honored through housing assistance programs acknowledging their sacrifices. These programs aim to ease the transition from military to civilian life by providing substantial support in acquiring a home. Recognizing these opportunities is essential for veterans looking to settle down post-service.

Veterans Housing Assistance Program (VHAP): Texas proudly offers VHAP, which provides veterans with low-interest land loans, home loans, and home improvement loans. This program stands as a gesture of gratitude towards those who've served, offering them a pathway towards homeownership.

- Federal VA Loan Guaranty Program: The VA Loan Guaranty Program is another significant benefit for veterans, offering no down payment options and no private mortgage insurance requirements. It's backed by the federal government, ensuring security and support for veteran borrowers.

- Additional State Benefits for Texas Veterans: Beyond VHAP, Texas veterans may access additional state benefits like property tax exemptions. These benefits further alleviate the financial burden of homeownership and are an expression of appreciation from the state of Texas.

- Tips for Maximizing Veteran Housing Benefits:

- Educate yourself on all available programs specific to your state.

- Combine federal VA benefits with state-specific programs when possible.

- Consult with a VA-approved lender who understands military-specific conditions.

- Maintain good credit scores to qualify for better loan terms.

- Explore additional tax benefits or exemptions you may be eligible for as a veteran.

The Application Process for Down Payment Assistance

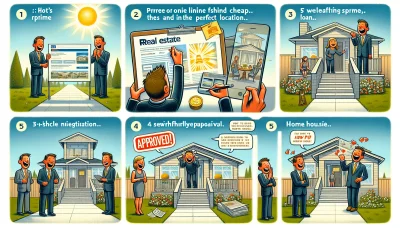

Steps to Apply for Down Payment Help in Texas

Navigating the application process for down payment assistance in Texas is like discovering a hidden treasure that can turn your homeownership dreams into reality! The journey begins with a vital first step: enrolling in a pre-purchase homebuyer education course. These courses are golden tickets, providing you with crucial knowledge about the home buying process and financial management.

Next, embark on the quest to find participating lenders. These financial allies are approved to work with down payment assistance programs and will be your guides, helping you secure the necessary funds. Partnering with the right lender is akin to choosing the best gear for a quest its essential!

Completing the application package is the climax of this epic journey. It's your showcase, demonstrating your eligibility and readiness to become a homeowner. This package is a compilation of personal and financial documents that will be scrutinized, so meticulous attention to detail is paramount.

Pre-Purchase Homebuyer Education Courses

These courses are not just a formality; they're power-ups for potential homeowners! They arm you with knowledge about budgeting, financing, and navigating the real estate market. Think of them as strategic planning sessions that prepare you for the battles ahead in the home buying process.

Completion of these courses often unlocks access to assistance programs. They ensure that you're not just jumping into homeownership you're making a calculated leap with eyes wide open, ready for what lies ahead.

Finding Participating Lenders

The quest for the perfect lender is critical; it's like finding a trusted sidekick. These lenders have been vetted and authorized to offer down payment assistance, and they know exactly how to navigate these waters. Their expertise is invaluable they'll help steer your ship through the often-turbulent seas of home financing.

When choosing your lender, look for those who have experience with down payment assistance programs. They should be enthusiastic about guiding you through this complex maze and committed to securing the best outcome for you.

Completing the Application Package

Gathering your documents for the application package is like assembling all the pieces of a puzzle. Youll need proof of income, employment verification, credit reports, and more. Each document adds clarity to your financial picture, so accuracy and completeness are critical.

Your completed application package is your storybook, laying out your financial journey for lenders to read. It must be coherent and compelling a true reflection of your readiness to take on the responsibility of homeownership.

Common Pitfalls to Avoid During Application

- Incomplete or Incorrect Documentation: This is like showing up to a duel without your sword it's simply not an option! Ensure every form is filled out completely and accurately.

- Missing Deadlines for Program Enrollment: Time waits for no one! Mark those deadlines in red on your calendar and set multiple reminders; missing them could mean missing out on assistance altogether.

- Misunderstanding the Terms of Assistance: Misinterpretation here can lead to future conflicts or surprises. Treat understanding these terms as if you're learning a new language study diligently until its second nature.

Avoiding these pitfalls requires vigilance and attention to detail. Incomplete or incorrect documentation could result in delays or rejection of your application an avoidable setback on your path to homeownership.

Deadlines are unforgiving cliffs from which there's no return once missed. Stay proactive; keep track of all key dates throughout this process. Finally, misunderstanding terms can lead to rough seas ahead; clarity now means smooth sailing later.

Financial Planning for Future Homeowners

Budgeting for Homeownership Beyond the Down Payment

When you're dreaming of owning a home, it's crucial to look beyond the down payment. Factoring in all potential expenses will ensure financial stability. The cost of homeownership extends far beyond the initial purchase price!

Estimating monthly mortgage payments is a cornerstone of homeownership budgeting. It's not just about the principal amount; interest rates and loan terms play pivotal roles in determining your monthly commitment. Be sure to use an accurate mortgage calculator to get a realistic figure!

Don't overlook property taxes and insurance when calculating homeownership costs. These recurring fees can significantly impact your monthly budget, and they often rise over time. Stay ahead by researching local tax rates and insurance costs in your desired area.

Saving for maintenance and unexpected expenses is non-negotiable. A leaky roof or a broken appliance can catch you off guard if you're not prepared. Aim to set aside a percentage of your homes value each year to cover these inevitable costs.

Long-Term Benefits of Down Payment Assistance

Down payment assistance programs are more than just an upfront financial aid; they're a gateway to long-term homeownership benefits. By reducing the initial financial burden, these programs can open doors to better financial futures.

Building equity sooner is a tangible benefit of down payment assistance. With a larger equity stake from the get-go, you'll increase your ownership faster with every mortgage payment, propelling you toward financial freedom.

Reducing overall interest paid on your mortgage is another perk of down payment assistance. A larger down payment typically means borrowing less, which translates into paying less interest over the life of your loana smart move for long-term savings!

Enhancing creditworthiness might not be the first thing you think of with down payment assistance, but it's certainly an advantage. Demonstrating the ability to manage sizable loans responsibly can boost your credit score, paving the way for better borrowing terms in the future.

- Create a solid emergency fund: Aim for at least three to six months worth of living expenses.

- Maintain good credit: Pay bills on time and keep debt levels low to secure favorable mortgage rates.

- Research thoroughly: Explore various mortgage options and down payment assistance programs available in your area.

- Plan for additional costs: Include moving expenses, furniture, and immediate home improvements in your budget.

- Avoid lifestyle inflation: Just because you can afford more house doesnt mean you should max out your budget.

- Stay informed about market trends: Understanding real estate cycles can help you make better timing decisions for purchasing a home.

- Talk to professionals: Consult with real estate agents, mortgage brokers, and financial advisors to navigate homeownership planning effectively.

Legal and Regulatory Aspects of Down Payment Assistance

Understanding the Legal Framework of Assistance Programs

Down payment assistance programs are governed by a complex web of regulations designed to ensure fair access and prevent abuse. Prospective homebuyers must navigate these rules carefully to benefit from such programs. It's crucial to understand that these frameworks are in place to protect both the consumer and the integrity of the housing market.

Federal and state agencies often have distinct guidelines for down payment assistance. Federal initiatives like FHA loans have their own set of criteria, which can differ markedly from state-funded assistance programs. It's imperative to research and understand the specific regulations applicable to your chosen program.

Adherence to Fair Housing Laws is non-negotiable when it comes to down payment assistance. These laws prevent discrimination based on race, color, national origin, religion, sex, familial status, or disability. Ensuring compliance is not only a legal mandate but also a moral obligation for all participants in the housing market.

The Consumer Financial Protection Bureau (CFPB) plays a pivotal role in overseeing financial transactions involving down payment assistance. The CFPB ensures that lenders engage in fair practices and that consumers are well-informed about their rights and the terms of their agreements.

Federal vs. State Regulatory Requirements

Federal regulations typically set the baseline requirements for down payment assistance programs, but states can impose additional criteria or offer separate programs with their own rules. This dual-layered regulatory environment means that some programs may be more accessible or advantageous depending on your state of residence.

State-specific programs can provide advantages tailored to local markets and economies. They might offer better interest rates, reduced fees, or additional benefits for residents. However, they may also come with unique qualifications or limitations that require careful consideration.

Compliance with Fair Housing Laws

Compliance with Fair Housing Laws is essential for any entity involved in providing down payment assistance. These laws ensure that all individuals have an equal opportunity to purchase a home without facing discrimination. Violations can lead to severe penalties, including fines and legal action.

Lenders and assistance providers must conduct regular training and audits to guarantee compliance with these critical laws. Failure to do so not only harms potential homebuyers but also jeopardizes the reputation and operational standing of financial institutions.

Role of the Consumer Financial Protection Bureau (CFPB)

The CFPB serves as a watchdog for consumers in the housing market, ensuring transparency and accountability from lenders offering down payment assistance. The bureau provides resources for buyers to understand their rights and for lenders to maintain compliant practices.

In case of disputes or uncertainties regarding down payment assistance transactions, the CFPB acts as an intermediary to resolve issues. Consumers can file complaints directly with the bureau if they believe their rights have been violated or if they've been misled during the process.

Tax Implications of Receiving Down Payment Help

- Taxable Benefits vs. Non-Taxable Grants: Not all down payment assistance is created equal when it comes to taxes. While grants might not be taxable income, other forms of aid could be considered taxable benefits by the IRS.

- Reporting Assistance on Tax Returns: Homebuyers should meticulously document any received assistance and seek professional advice when filing tax returns to ensure accuracy and compliance with tax laws.

- Potential Deductions for Homebuyers: Some types of down payment aid may provide tax deductions under certain conditionsanother compelling reason why understanding tax implications is indispensable.