2024 housing market Quiz

Test Your Knowledge

Question of

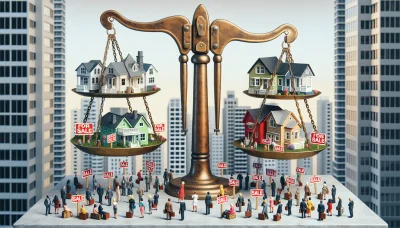

Understanding the 2024 Housing Market Forecast

The 2024 housing market forecast is generating buzz and anticipation among investors, homebuyers, and industry professionals alike. As we look ahead, it's crucial to understand the dynamics that could shape the real estate landscape. Experts are piecing together a variety of data points to offer valuable insights into future market conditions.

With new construction technologies and changing demographics, the upcoming trends are bound to be fascinating. The forecast is not just about prices; it also encompasses shifts in buyer preferences, regional hotspots, and the balance between urban versus suburban living. Staying abreast of these predictions can mean the difference between making a savvy investment and missing out on an opportunity.

Predicting Real Estate Trends

To accurately predict real estate trends for 2024, analysts scrutinize patterns from previous years. They examine factors such as housing demand, inventory levels, and emerging market influences. This historical analysis provides a foundation for forecasting future movements in the housing sector.

Emerging trends like remote work are also impacting where people choose to live, altering demand in unexpected ways. Additionally, lifestyle changes and consumer preferences continue to shape the types of properties that are in demand. By understanding these subtleties, one can anticipate where the market is headed.

Analyzing Past Market Cycles

Past market cycles offer invaluable lessons for predicting future real estate dynamics. By examining boom-and-bust periods, analysts can identify indicators that signal shifts in market momentum. These cycles provide a roadmap for what might unfold in 2024.

One must consider factors like economic growth, employment rates, and demographic changes when looking at past cycles. These elements play critical roles in driving or dampening housing market activity. Understanding these relationships helps paint a clearer picture of what's to come.

Utilizing Economic Indicators

Economic indicators are essential tools for forecasting the housing market's direction. Indicators such as GDP growth rates, job creation figures, and consumer confidence indices provide insight into the overall health of the economy and its impact on real estate.

For instance, strong job growth typically leads to increased housing demand as more individuals can afford homeownership. Conversely, indicators showing economic slowdowns may signal caution among potential buyers. Keeping an eye on these indicators is key for anyone involved in real estate.

Impact of Interest Rates on Home Buying

The influence of interest rates on home buying cannot be overstated. As interest rates rise, mortgage payments become more expensive, which can cool down a hot housing market by making homes less affordable for buyers.

In contrast, lower interest rates tend to stimulate home buying by making mortgages more affordable. Prospective homeowners often rush to secure loans when rates are favorable, which can lead to increased competition for available homes.

Federal Reserve Policy Predictions

Federal Reserve policies have a profound impact on interest rates and consequently the housing market. Predictions about their upcoming decisions are eagerly awaited by industry watchers who understand their significance.

If the Federal Reserve signals a tightening of monetary policy with higher interest rates to combat inflation, this could translate into a more challenging environment for borrowers. Conversely, a dovish stance might make mortgages more accessible and boost the housing sector.

Mortgage Rate Trends and Affordability

-

Tips for Home Buyers Considering Mortgage Rate Trends:

- Monitor Economic Forecasts: Stay informed about projections for interest rate changes to time your purchase strategically.

- Consider Fixed Rates: Locking in a fixed mortgage rate can protect you against future increases during periods of volatility.

- Assess Your Budget: Calculate how rate changes will affect your monthly payments and overall affordability before committing to a loan.

- Explore Loan Options: Shop around with different lenders to find competitive rates and terms that suit your financial situation.

Mortgage rate trends directly influence home affordability and buyer behavior. As we move towards 2024, prospective buyers should keep a close watch on these trends to make informed decisions about entering the market.

Affordability challenges may arise if mortgage rates increase significantly; however, this could also lead to decreased competition amongst buyers. Understanding how mortgage rate trends interact with affordability is crucial for anyone considering purchasing property in 2024.

Key Factors Influencing the 2024 Real Estate Market

Government Housing Policies and Regulations

The real estate landscape in 2024 is significantly shaped by governmental policies. New regulations are introduced to ensure housing affordability and market stability. These policies are pivotal, affecting everything from interest rates to lending practices, and they dictate the ease with which individuals can buy or sell properties.

Environmental considerations are now at the forefront of housing policies, with green building codes becoming stricter. This shift not only promotes sustainability but also affects construction costs and property values. Buyers and sellers must stay informed about these regulations to navigate the market effectively.

New Legislation Impacting Homeownership

Homeownership is directly influenced by recent legislative changes. Laws focusing on consumer protection, fair housing, and property taxes are reshaping the buying experience. These changes aim to make homeownership more accessible while protecting consumers from predatory lending and discriminatory practices.

Legislation that streamlines the approval process for new constructions is also underway, potentially boosting housing supply. This could lead to more competitive pricing and a dynamic real estate market that favors both first-time buyers and seasoned investors.

Tax Incentives and Credits for Buyers and Sellers

In an effort to stimulate the real estate market, governments are offering various tax incentives. These incentives serve as a powerful tool for buyers to offset purchase costs and for sellers to maximize their returns. Understanding these financial benefits is crucial for anyone looking to enter the market.

Tax credits for energy-efficient home improvements are especially popular, encouraging homeowners to invest in eco-friendly upgrades. Such initiatives not only reduce long-term living costs but also increase property attractiveness in a market increasingly aware of environmental impact.

Technological Advancements in Real Estate

Technology is revolutionizing how we buy, sell, and interact with real estate. The integration of tech in this sector is enhancing transparency, efficiency, and customer satisfaction. Staying abreast of these advancements is no longer optional; it's imperative for success in the modern real estate world.

Data analytics tools are now indispensable in understanding market trends and property valuations. They offer unprecedented insights that help both professionals and consumers make informed decisions swiftlya clear competitive edge in today's fast-paced market.

The Rise of Virtual Home Tours

Virtual home tours have become a standard practice by 2024, offering convenience and safety for potential buyers. This technology allows immersive property viewing experiences from anywhere in the world, broadening the buyer pool significantly for sellers.

- High-Quality Imagery: Crisp visuals capture every detail of a property, making virtual tours almost as good as being there in person.

- User Control: Interactive features let users explore properties at their own pace, focusing on areas of interest without pressure.

- Accessibility: Virtual tours remove geographical barriers, opening up markets beyond local buyers.

- Time Efficiency: Saving time on travel, these tours allow more properties to be viewed within a shorter timeframe.

- Cutting-Edge Tech: As technology advances, expect even more realistic simulations with augmented reality (AR) enhancements.

Blockchain and Real Estate Transactions

The adoption of blockchain technology is disrupting traditional transaction processes in real estate. It provides a secure, transparent way of conducting transactions that reduces fraud risk and accelerates closing timesa win-win for all parties involved.

This decentralized approach further democratizes real estate investment by enabling fractional ownerships through tokenization. Such innovations open up new investment opportunities and simplify complex processes like title transfers, making them less daunting for everyone involved.

Hot Markets to Watch

The upcoming year promises to be exhilarating for certain real estate markets. Analysts predict a surge in both residential and commercial investments in specific areas. The focus is on regions with robust economic growth, job creation, and infrastructural developments.

Investors should keep a keen eye on tech hubs and cities with burgeoning industries. These hot markets are not just limited to the coastal elites but also include mid-size cities with potential for tech expansion and a growing creative class. Renewable energy sectors are also propelling certain markets into the spotlight.

Emerging Neighborhoods and Cities

Emerging neighborhoods are set to outshine the rest in 2024, offering incredible opportunities for savvy investors. Urban renewal projects and public-private partnerships are fueling the transformation of these areas into vibrant communities.

As you scout for emerging cities, look for signs of new infrastructure, such as transit lines or cultural centers that can boost property values. Also, pay attention to policy changes that incentivize development or attract new businesses. These indicators often precede a neighborhood's rise to prominence.

Cooling Markets and Areas to Avoid

While some markets sizzle, others may fizzle out. High-cost living areas are seeing an exodus of residents seeking affordability elsewhere. This shift is causing property values in previously hot markets to plateau or even decline.

Real estate investors must be cautious about overvalued markets showing signs of saturation or economic downturns. It's essential to conduct thorough research and avoid areas with declining population growth, stagnant job markets, or oversupply of housing units.

The Role of Urbanization and Migration Patterns

Urbanization continues to shape real estate landscapes dramatically. Cities that offer a blend of lifestyle amenities, connectivity, and employment opportunities continue to attract a diverse population.

- Monitor Urban Trends: Stay informed about urban planning initiatives that can impact property demand.

- Evaluate Transportation Developments: New transit options can significantly increase property values in connected areas.

- Spot Economic Indicators: Job market health is directly tied to real estate trends; thriving job markets often lead to hot real estate markets.

- Avoid One-Industry Towns: Diversification in the local economy is crucial; reliance on a single industry can be risky if that sector falters.

- Assess Lifestyle Factors: Urban areas with a rich array of amenities like parks, cultural institutions, and restaurants tend to draw more residents and retain value.

- Beware of Overdevelopment: Too much construction can lead to an oversupply of properties, making some urban areas less desirable investments.

In addition, migration patterns reveal significant shifts from dense urban centers to suburban and rural locales as remote work becomes normalized. This trend is creating pockets of opportunity in areas once considered too remote for traditional commuters.

Population Shifts to Suburban and Rural Areas

The allure of urban life is being balanced by the charm and space offered by suburban and rural settings. The rise of telecommuting has empowered many to live further from their workplaces without compromising their careers.

This decentralization trend is not just about more space; it's also about quality of life. Suburban towns with good schools, low crime rates, and community amenities are on the rise. Developers should focus on these aspects when planning new projects in these areas.

The Revitalization of Downtown Cores

Downtown cores across various cities are experiencing a renaissance as mixed-use developments bring new energy into these historic districts. These revitalizations often lead to increased property values as downtowns become destinations for both living and entertainment.

This resurgence is not just driven by young professionals but also by empty nesters seeking vibrant lifestyles post-retirement. With this diverse demographic mix, downtown cores are becoming eclectic communities that offer something for everyone.

Investment Strategies for the 2024 Property Market

Building a Real Estate Portfolio

The cornerstone of building a robust real estate portfolio in 2024 lies in strategic acquisitions. Investors should focus on properties with strong growth potential and stable cash flow. It's crucial to perform due diligence, considering factors such as location, demographic trends, and economic indicators that can drive property values over time.

Leveraging technology is key. Utilize cutting-edge tools for market analysis and property management to streamline operations. This tech-forward approach can enhance decision-making processes and boost overall efficiency, giving investors an edge in a competitive market.

Diversification Across Property Types

Diversifying your portfolio across different property types is a powerful strategy to mitigate risk. Residential, commercial, and industrial properties each respond differently to economic cycles. By spreading investments across these sectors, you can protect your portfolio from market fluctuations.

Consider emerging niches within the property market, such as eco-friendly buildings or co-living spaces. These sectors are gaining traction and may offer unique opportunities for growth as consumer preferences evolve.

Long-Term vs. Short-Term Investment Approaches

Long-term investment strategies often involve buying and holding properties to benefit from capital appreciation and rental income over time. This approach requires patience but can result in significant wealth accumulation.

Conversely, short-term strategies like flipping properties or investing in real estate investment trusts (REITs) can provide quicker returns. However, they typically involve higher risk and require a more active management style.

Risk Management in Real Estate Investing

Effective risk management is paramount for any real estate investor looking to succeed in 2024. Understanding the interplay between local and global economic factors can help anticipate market shifts. Stay informed on regulatory changes, interest rate movements, and international trade agreements as they can profoundly impact the property market.

- Analyze historical data to predict future trends.

- Build a cash reserve to cushion against unexpected expenses.

- Regularly reassess your portfolio's performance against benchmarks.

- Maintain a diverse portfolio to spread risk.

- Stay informed about local zoning laws and potential changes.

- Collaborate with experienced realtors and advisors.

- Consider exit strategies for each investment.

Assessing Market Volatility

Real estate markets are inherently volatile; thus, assessing this volatility is crucial for making informed decisions. Use predictive analytics to gauge potential market swings and position your portfolio accordingly.

Keep an eye on leading indicators such as employment rates, GDP growth, and construction activity. These indicators can provide early warnings of market changes that might affect property values.

Insurance and Protection Against Market Downturns

Insurance products are essential tools for protecting your investments against unforeseen events. From natural disasters to tenant defaults, ensure you have comprehensive coverage tailored to the risks associated with each property.

Consider adding clauses to leases that protect your income stream during economic downturns or pandemics. Clauses such as rent abatement limits or co-tenancy agreements can provide additional security layers.

Navigating the Buyer's Journey in 2024

Steps to Homeownership

The path to homeownership starts with understanding your financial landscape. Analyze your credit score, debts, and income to see where you stand. A strong financial foundation can significantly ease the mortgage process.

Next, its about setting a realistic budget. Factor in not just the price of the home but also closing costs, moving expenses, and any immediate renovations. Stick to this budget throughout your house-hunting journey.

Preparing for Mortgage Approval

Becoming mortgage-ready is a critical step. Gather all necessary documents such as proof of income, tax returns, and bank statements beforehand. Lenders love a well-prepared applicant.

It's also crucial to understand different mortgage options available. Fixed-rate or adjustable, each has its pros and cons based on your long-term financial goals. Consult with a mortgage advisor to find the best fit for you.

Searching for the Right Property

Begin by listing out must-haves versus nice-to-haves in your future home. This will streamline your search and help your real estate agent find suitable listings faster.

Touring properties can be exhilarating but remember to stay objective. Evaluate each home's condition and potential costs for repairs or upgrades that may be needed down the line.

Overcoming Common Home Buying Challenges

Dealing with Bidding Wars and Multiple Offers

- Get Pre-approved: This shows sellers youre serious and ready to buy.

- Be Flexible: Consider concessions like a flexible closing date to appeal to sellers.

- Add a Personal Touch: Sometimes a heartfelt letter can make your offer stand out.

- Increase Your Offer Incrementally: Small increases can sometimes win a bidding war without breaking the bank.

- Hire an Experienced Agent: They'll know how to navigate these waters strategically.

Bidding wars are common in hot markets. Be prepared with a pre-approval and work closely with your agent to make competitive offers. Remember, it's not always about the highest bid; terms are equally important.

Finding Affordable Housing Options

Affordable housing might seem elusive, but exploring different neighborhoods or considering homes that need some TLC can unveil hidden gems. Be open-minded about location and property types.

New home buyers should also look into government programs or grants available for first-time buyers. These programs can provide financial assistance or favorable loan terms, making homeownership more accessible.

Selling Property in a Changing Market Environment

Preparing Your Home for Sale

The real estate market is dynamic, and preparing your home for sale demands strategic planning. Start with a thorough cleaning and decluttering to make the space inviting. Consider depersonalizing by removing personal items so potential buyers can envision themselves living there.

Repairs are non-negotiable; fix any leaks, squeaks, or malfunctions before listing. These issues might seem minor, but they can be deal-breakers for savvy buyers. Lastly, enhance your curb appeal as first impressions are pivotal in real estate transactions.

Home Staging and Renovation Tips

Staging your home can significantly boost its marketability. Rent modern furniture and use neutral colors to create a broad appeal. Maximize natural light with mirrors and clean windows bright homes sell! Strategic renovations in key areas like the kitchen or bathroom can offer substantial returns on investment.

Avoid over-personalizing renovations; you want to strike the perfect balance between trendy and timeless. Remember, less is more when it comes to staging allow the space to speak for itself.

Setting a Competitive Listing Price

Setting the right price is crucial too high and you deter potential buyers, too low and you leave money on the table. Conduct a comparative market analysis (CMA) to understand local trends. Consider hiring an appraiser for an unbiased valuation of your property.

Be prepared to adjust your price based on feedback and market movement. A flexible pricing strategy can make all the difference in closing a sale efficiently in a changing market environment.

Closing the Deal Successfully

Closing a property sale is about precision timing and negotiation finesse. Be responsive to offers and show willingness to work with interested parties. Always maintain a professional demeanor emotions can impede objective decision-making.

Create a sense of urgency without appearing desperate. Buyers tend to act quickly if they believe they may miss out on a great opportunity. However, don't rush into accepting an offer that doesn't meet your minimum requirements.

Negotiation Strategies for Sellers

- Know Your Bottom Line: Understand your minimum acceptable offer before negotiations begin.

- Maintain Flexibility: Be willing to negotiate on terms other than price, such as closing date or included appliances.

- Avoid Emotional Selling: Keep emotions in check; focus on factual aspects of the home and deal terms.

- Counteroffer Wisely: When making a counteroffer, make it clear why your property is worth that value.

- Use Time Limits: Set deadlines for offer acceptance to create urgency and prompt decision-making from buyers.

Understanding Closing Costs and Procedures

Closing costs can be surprising if not anticipated; they typically range from 2% to 5% of the property's sale price. Familiarize yourself with common expenses such as title insurance, attorney fees, and realtor commissions. Transparency about these costs upfront can prevent last-minute hiccups during closing procedures.

Last but not least, stay informed about legal requirements in your area regarding property sales. Ensure all necessary documents are ready well before closing day to guarantee a smooth transaction process.

The Future of Housing: Sustainability and Innovation in 2024

Eco-Friendly Homes and Green Building Practices

Imagine a world where every home is a beacon of efficiency and harmony with nature. That's the vision for eco-friendly homes in 2024, utilizing green building practices that minimize environmental impact. From the use of sustainable materials to innovative design, these homes are not just structuresthey're ecosystems in their own right.

Builders and architects are pushing the envelope, creating homes that blend with their surroundings. These structures often feature living roofs, rainwater harvesting systems, and landscaping that supports local wildlife. The result is a living space that gives back to the environment while providing a healthy, serene place for people to thrive.

Energy-Efficient Design and Materials

The race is on to slash our carbon footprint, and energy-efficient design is leading the charge. Homes in 2024 are expected to be marvels of conservation, with materials that insulate better, windows that reflect heat, and layouts that take full advantage of natural light. The aim is clear: cut down on energy consumption without compromising on comfort or style.

New materials are revolutionizing construction, offering durability and efficiency in one package. These include high-performance insulation options and advanced glass technology for windows. Coupled with passive solar design principles, these materials help maintain consistent indoor temperatures year-round, drastically reducing reliance on heating and cooling systems.

Government Incentives for Sustainable Development

To propel the adoption of sustainable housing, governments worldwide are stepping up with incentives. Tax breaks, subsidies, and grants are becoming more prevalent for those who choose to go green. This support makes sustainable development not just an environmental choice but an economically savvy one too.

Incentive programs often target both builders and homeowners, covering everything from solar panel installations to energy-efficient appliances. As these incentives grow more robust, they lay the groundwork for a seismic shift in how we think about building and living in our homesa shift towards sustainability as the default mode.

Smart Home Technology and Automation

The smart home revolution is transforming living spaces into hubs of convenience and intelligence. By 2024, home automation systems will be even more intuitive, learning from inhabitants' habits to create the perfect environment for every moment. Whether it's adjusting lighting or preheating the oven on your way home, smart homes cater to your needs seamlessly.

Automation extends beyond convenience; it's a pillar of energy efficiency. Smart thermostats can optimize heating and cooling schedules while connected appliances manage their power usage proactively. This synergy between technology and sustainability is paving the way for a future where smart living is simply smarter living.

The Integration of IoT Devices in Homes

- Enhanced Control: IoT devices offer unparalleled control over home systems from anywhere at any time.

- Data Insights: Homeowners gain valuable insights into their usage patterns enabling more informed decisions about energy use.

- Maintenance Predictions: Predictive analytics can alert homeowners about maintenance issues before they become problematic.

- Voice-Activated Convenience: Voice assistants can integrate with IoT devices for hands-free operation throughout the home.

Security and Privacy Concerns in Connected Homes

As homes get smarter, security concerns skyrocketcybersecurity becomes as important as physical safety. Manufacturers must prioritize robust security protocols to protect users' data from breaches. Homeowners will need to stay vigilant about updating software to fend off potential threats.

Maintaining privacy within a web of connected devices poses another challenge. In 2024, transparent privacy policies will be crucial as consumers demand clarity on how their data is used and shared. It's essential that trust goes hand-in-hand with innovation for smart homes to truly become sanctuaries of the modern age.