Real investments Quiz

Test Your Knowledge

Question of

Understanding Real Estate Investments

Real estate investments stand as a robust avenue for generating wealth, offering a variety of options for investors. By understanding the landscape, you can tailor your investment strategy to fit your financial goals and risk tolerance. The essence of real estate investing lies in purchasing property to generate income or appreciate over time.

Diving into real estate requires a solid grasp of the market dynamics and the different types of properties available. It's not just about buying a piece of land; it's about making informed decisions that will contribute to your financial well-being. With the right knowledge, you can navigate the complexities of the real estate market with confidence.

Types of Real Estate Investments

Residential Properties

Investing in residential properties is a popular starting point for many investors. These properties include single-family homes, apartments, and condos. The goal here is often to rent out these properties to tenants, creating a steady stream of passive income. This type of investment is particularly appealing because it's relatable; people always need a place to live.

Commercial Real Estate

Commercial real estate involves investing in business properties such as offices, retail spaces, and warehouses. This sector usually offers higher returns but comes with its own set of challenges, including longer lease agreements and a more significant initial investment. Commercial properties are often seen as a step up from residential investments due to their potential for higher income.

Industrial Properties

Industrial properties include manufacturing buildings, distribution centers, and storage units. These investments often come with long-term leases and can offer stable income streams. Industrial real estate is critical for logistics and supply chain operations, making it an essential part of the economy.

Benefits of Investing in Real Estate

The allure of real estate investing lies in its potential to offer long-term financial security. Unlike stocks and bonds, real estate is a tangible asset that can appreciate over time while providing immediate benefits like rental income. It's a powerful tool for building wealth and securing your financial future.

One of the most enticing aspects of real estate investment is the passive income potential. By owning rental properties, you can generate a steady stream of income without the daily grind associated with traditional jobs. This can lead to financial independence and the freedom to pursue other interests or investments.

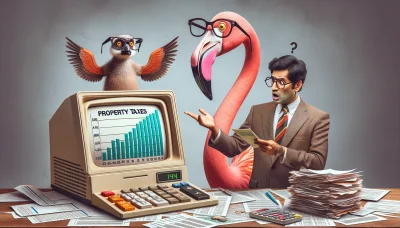

- Tax Advantages: Real estate investors enjoy numerous tax benefits, including deductions on mortgage interest, property taxes, and depreciation. These advantages can significantly reduce your taxable income and increase your overall return on investment.

- Leverage: Real estate allows for leverage through mortgage financing, enabling investors to purchase properties with a fraction of the total cost upfront. This can amplify returns but also increases risk.

- Hedge Against Inflation: Real estate often acts as an effective hedge against inflation. As living costs increase, so do rental prices and property values, protecting investors' purchasing power.

- Diversification: Adding real estate to an investment portfolio can provide diversification benefits, reducing overall risk by spreading investments across different asset classes.

Tax advantages are another compelling reason to invest in real estate. The ability to deduct expenses such as mortgage interest and property depreciation can lead to significant tax savings. Moreover, certain strategies like 1031 exchanges allow investors to defer capital gains taxes when selling one investment property and purchasing another.

Getting Started with Real Estate Investing

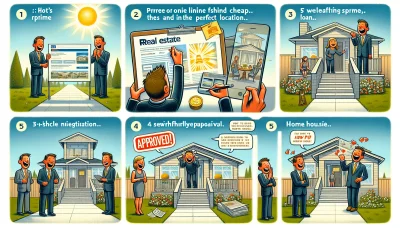

Building a Solid Investment Plan

Embarking on your real estate investment journey begins with crafting a robust investment plan. This foundational step is non-negotiable! A well-thought-out plan acts as your roadmap, guiding you through the complexities of the real estate market. It's the blueprint that aligns your financial goals with actionable steps, ensuring you're not shooting in the dark but aiming for success.

Setting Clear Investment Goals is paramount. Whether you're aiming for long-term wealth accumulation or seeking immediate cash flow, clarity in your objectives sets the tone for your entire strategy. It's about knowing your destination before you start the journey, making every decision and action intentional and focused.

Next up, Assessing Your Financial Capacity is critical. Understand what you can afford to invest without jeopardizing your financial health. This involves evaluating your savings, income, and ability to secure loans. Being realistic about your financial situation prevents overextension and minimizes risks.

Understanding Market Trends cannot be overlooked. The real estate market is influenced by various factors including economic indicators, interest rates, and regional development plans. Staying informed about these trends helps you make educated decisions, identifying lucrative investment opportunities while avoiding potential pitfalls.

Financing Your Real Estate Investment

Finding the right financing option is a cornerstone of successful real estate investing. It's about leveraging available resources to maximize returns while minimizing out-of-pocket expenses. The world of real estate financing offers multiple pathways to secure funds; choosing wisely can make all the difference.

Mortgage Options for Investors are plentiful but choosing the right one demands careful consideration. Fixed-rate mortgages offer stability in payments, while adjustable-rate mortgages may provide lower initial rates. Understanding the pros and cons of each can align financing with your investment strategy and risk tolerance.

- Raising Capital Through Partnerships: Pooling resources with partners can increase buying power and spread risk. However, it's vital to enter partnerships with clear agreements and shared goals to avoid conflicts.

- Exploring Real Estate Investment Trusts (REITs): REITs offer a way to invest in real estate without owning physical properties. They're ideal for investors seeking exposure to real estate markets with less capital and lower risk compared to direct property investments.

In conclusion, getting started with real estate investing is an exhilarating journey filled with opportunities for growth and profit. By building a solid investment plan and securing appropriate financing, you pave the way toward achieving your financial goals. Remember, success in real estate investing requires dedication, research, and strategic planningstart laying your foundation today!

Property Analysis and Selection

Embarking on the journey of property investment requires a keen eye, a strategic mindset, and an unwavering commitment to conducting thorough market research. It's the cornerstone of identifying lucrative opportunities and mitigating potential risks. This process is not just about looking at numbers; it's about understanding the heartbeat of the market.

In the realm of property investment, every decision counts. That's why diving deep into market research is not just recommended; it's essential! From analyzing neighborhood dynamics to evaluating property values and trends, every step you take is a step towards securing your financial future.

Conducting Market Research

Analyzing Neighborhood Dynamics

Understanding the pulse of the neighborhood is critical. It involves examining local amenities, schools, employment rates, and crime statistics. These factors directly influence property demand and values. A thriving neighborhood equates to a thriving investment.

Neighborhood dynamics can make or break your investment. It's about more than just the present; it's about forecasting future desirability. The key lies in identifying areas on the brink of growth or regeneration, offering a unique window of opportunity for savvy investors.

Evaluating Property Values and Trends

Evaluating property values and trends is akin to reading the market's tea leaves. It requires analyzing historical data, current market conditions, and future projections to gauge potential appreciation or depreciation. This insight is invaluable in making informed decisions.

Trends offer a glimpse into the future. Whether its rising property values in emerging neighborhoods or stagnation in established areas, these insights help investors pinpoint where to invest for maximum returns. Ignoring trends is like sailing without a compassrisky and ill-advised.

Identifying Growth Opportunities

Spotting growth opportunities before they become common knowledge is what sets successful investors apart. It involves analyzing economic indicators, infrastructure developments, and government initiatives that could spur growth in overlooked areas.

Growth opportunities are the golden tickets of real estate investing. They require diligence, foresight, and sometimes a bit of luck to identify. But once found, they can transform a modest investment into a substantial fortune.

Due Diligence Before Purchase

Inspecting the Physical Condition of Properties

The physical condition of a property speaks volumes about its true value and potential costs down the line. Comprehensive inspections covering everything from structural integrity to systems functionality are non-negotiables for serious investors.

Neglecting thorough inspections can lead to unforeseen expenses that eat into profits. Its not just about what meets the eye; its about uncovering potential issues that could turn a promising investment sour.

Reviewing Legal and Zoning Issues

Legal and zoning issues can be minefields for uninformed investors. Understanding local laws, restrictions, and potential zoning changes is crucial for assessing a propertys viability and avoiding costly legal battles or fines.

- Avoid overlooking local regulations: Ignorance isn't bliss when it comes to zoning laws and building codes; it's costly.

- Engage with planning departments: Establishing relationships with local planning departments can provide insights into future zoning changes or developments that might impact your investment.

- Conduct thorough title searches: Ensuring clear title is paramount; undisclosed liens or disputes can derail your investment before it even begins.

- Evaluate environmental restrictions: Environmental laws can impose limitations on development or renovations; always know what you're dealing with upfront.

Calculating Potential Returns on Investment

The endgame of property investment is realizing attractive returns on investment (ROI). This requires meticulous financial analysis to project income potentials against operating costs, taxes, interest rates, and eventual capital gains taxes on resale or rental income.

Failing to accurately calculate ROI is tantamount to flying blind in an already risky venture. Utilizing conservative estimates and accounting for all possible expenses ensures that youre not caught off guard by unforeseen costs that could diminish your returns.

Real Estate Investment Strategies

Active vs. Passive Investment Approaches

Active real estate investment, such as flipping houses, demands hands-on involvement and a deep understanding of the property market. It's a high-risk, high-reward venture that can yield significant profits if executed correctly. On the other hand, passive investments, like investing in real estate crowdfunding platforms, offer a more hands-off approach. This method allows investors to reap the benefits of the real estate market without dealing with the day-to-day management of properties.

Flipping Houses for Quick Profits involves purchasing undervalued properties, renovating them, and selling them at a higher price. Success in flipping requires precise budgeting and timing to maximize profits while minimizing holding costs. It's a strategy best suited for those with a good eye for potential and the ability to manage renovations efficiently.

Owning Rental Properties for Steady Income is a classic approach to building wealth in real estate. It provides investors with a steady stream of rental income while also benefiting from long-term property appreciation. Effective property management is key to ensuring high occupancy rates and minimizing maintenance costs.

Investing in Real Estate Crowdfunding Platforms has emerged as a popular passive investment strategy. These platforms allow investors to pool their resources to invest in larger projects than they might not be able to afford individually. It's an excellent way to gain exposure to the real estate market with lower capital requirements and risk exposure.

Diversifying Your Investment Portfolio

Diversification is crucial in real estate investment, just as it is in any other asset class. By spreading investments across different geographic locations, property types, and sizes, investors can mitigate risks and enhance potential returns. Geographic diversification protects against local market downturns, while varying property types can capitalize on different market trends.

Geographic Diversification in Real Estate involves investing in properties located in various regions or countries. This strategy helps shield your portfolio from localized economic downturns and takes advantage of growth in emerging markets. It's about not putting all your eggs in one basket but spreading them out to catch multiple opportunities.

- Mixing Property Types and Investment Sizes: Diversify by investing in both residential and commercial properties, as well as considering different investment scales - from small single-family homes to large apartment complexes or office buildings. Each type offers unique benefits and risks.

- Balancing Risk and Reward: High-risk investments can offer high returns but don't overlook safer options that provide steady income with less volatility. A balanced portfolio combines both approaches to stabilize income while seeking growth opportunities.

In conclusion, successful real estate investing requires a strategic approach that balances active involvement with passive income generation. Diversifying your portfolio across different geographic areas, property types, and investment sizes is essential for mitigating risk while maximizing potential returns. Whether you're flipping houses or investing through crowdfunding platforms, understanding these strategies can lead you on the path to financial success in the real estate market.

Managing Your Real Estate Assets

Effective Property Management Techniques

Finding and retaining tenants is crucial for the success of any real estate investment. It's all about creating a desirable living environment while also ensuring your marketing strategies are top-notch. Utilize online platforms and social media to reach a wider audience. Remember, a satisfied tenant is more likely to stay longer, reducing vacancy rates and increasing your revenue stability.

Handling maintenance and repairs proactively can significantly impact tenant satisfaction and the longevity of your property. Establish a responsive and reliable system for addressing issues, whether through an in-house team or contracted professionals. Regular inspections can prevent minor issues from becoming major problems, saving you money in the long run.

Implementing rent collection systems that are convenient for both you and your tenants can streamline your operations. Today's technology offers various tools for digital payment options that are secure, fast, and efficient. This not only improves cash flow but also enhances tenant experience by offering them easy ways to meet their obligations.

Enhancing Property Value

Renovation and upgrade strategies are essential for keeping your property competitive in the market. Focus on improvements that increase appeal and functionality, such as modernizing kitchens and bathrooms or enhancing outdoor spaces. These investments can lead to higher rents, improved tenant satisfaction, and ultimately, increased property value.

Implementing energy-efficient features is not just a trend; it's a smart investment strategy. Upgrades like energy-efficient windows, LED lighting, and high-efficiency HVAC systems can reduce operating costs and attract environmentally conscious tenants. These changes not only contribute to a healthier planet but also position your property as a desirable choice for prospective renters.

- Leveraging Technology for Property Management:

- Smart Locks: Enhance security and convenience with keyless entry systems.

- Property Management Software: Streamline operations from tenant screening to maintenance requests.

- Energy Monitoring Systems: Track usage and optimize energy consumption for cost savings.

- Online Tenant Portals: Offer tenants an easy way to pay rent, request maintenance, and communicate with management.

Leveraging technology in managing your real estate assets can transform how you operate. Smart locks improve security while making access easier for tenants. Property management software streamlines everything from tenant screening to maintenance requests, saving you time and effort. Energy monitoring systems help in optimizing consumption, leading to cost savings. Finally, online tenant portals enhance communication between you and your tenants, making their experience smoother and more satisfactory.

Navigating Legal and Tax Implications

Understanding Real Estate Laws and Regulations

Real estate laws and regulations are the backbone of property investment. They define what you can and cannot do, ensuring that your investment journey is both legal and fruitful. Understanding these laws is not just recommended; it's essential! From zoning laws to building codes, every detail matters in shaping your real estate venture.

Complying with Local Housing Codes is paramount. These codes dictate the standards for construction, maintenance, and overall safety of buildings. Ignoring them can lead to hefty fines or even legal action. It's not just about following rules; it's about providing safe and habitable spaces for people.

Navigating Landlord-Tenant Laws requires attention and diligence. These laws cover everything from lease agreements to eviction procedures, balancing the rights of landlords and tenants. Knowledge here is powerpower to manage your properties effectively and avoid costly disputes.

Adhering to Fair Housing Standards is not just a legal obligation but a moral one too. Discrimination has no place in real estate. By embracing fair housing practices, you ensure equal opportunities for all, fostering a diverse and inclusive community around your investments.

Optimizing Tax Benefits for Real Estate Investors

Tax benefits can significantly enhance the profitability of real estate investments. But to capitalize on these advantages, you must understand the intricacies of real estate taxation. This knowledge can transform tax time from a headache into an opportunity for savings!

Depreciation and Other Deductions are key tools in the investor's toolbox. Depreciation allows you to deduct the costs of buying and improving a property over its useful life, effectively reducing your taxable income each year. Coupled with deductions for interest, repairs, and management fees, depreciation can save you thousands.

- Avoid Common Mistakes:

- Not keeping detailed records of expenses and income can lead to missed deductions.

- Failing to separate personal finances from investment finances complicates tax filings.

- Overlooking passive activity loss rules might limit the deductions you can take now.

- Ignoring local tax implications could result in unexpected liabilities.

The 1031 Exchange , also known as a like-kind exchange, allows investors to defer capital gains taxes by reinvesting proceeds from real estate sales into new property investments. This strategy can significantly boost your investing power by keeping more capital at work rather than paying it out in taxes.

Estate Planning for Real Estate Holdings ensures that your investment benefits are preserved for future generations. Through tools like trusts or limited liability companies (LLCs), you can protect your assets from probate and minimize or avoid estate taxes, securing your legacy.

Exiting and Scaling Your Real Estate Investments

Timing the Market for Maximum Returns

The secret sauce to maximizing your real estate investment returns is all about nailing the timing. It's not just about selling; it's about selling at the perfect moment. This golden window ensures you're walking away with the heftiest profit margin possible. It requires a keen eye on market trends, an understanding of economic indicators, and a bit of intuition.

Recognizing the Right Time to Sell is paramount. This isn't guesswork; it's strategic planning. You need to be vigilant, watching out for signs of market peaking, such as skyrocketing property prices or a significant increase in demand. These indicators signal that it's time to make your move and sell for maximum gains.

Analyzing Market Cycles and Indicators is crucial for any investor looking to outsmart the market. By understanding where we are in the market cycle, whether it's an upswing or downturn, you can make informed decisions that align with your investment goals. Keep an eye on interest rates, employment rates, and other economic indicators that influence real estate values.

When it comes to Projecting Future Market Conditions , nobody has a crystal ball. However, by analyzing historical data and current trends, you can make educated guesses about where the market is headed. This foresight can be your best ally in deciding when to sell or hold onto your properties.

Strategies for Scaling Your Real Estate Portfolio

Growing your real estate portfolio doesn't happen by chance; it's the result of deliberate strategies and reinvestments. The goal here is clear: expand your holdings to amplify your income streams and overall wealth. It's about playing smart and making your investments work harder for you.

Reinvesting Profits into New Properties is a powerful strategy for scaling. By taking the profits from one sale and investing them into another property, you're essentially using your success to fuel further growth. This compounding effect can significantly accelerate the expansion of your portfolio.

- Leveraging Equity to Expand Holdings: One of the most effective ways to scale is by using the equity from existing properties as leverage to acquire more real estate. This approach allows you to grow your portfolio without having to liquidate assets.

- Building a Team to Support Growth: As you scale, managing multiple properties can become overwhelming. That's why building a reliable team is essential. From property managers to financial advisors, having experts by your side can streamline operations and boost efficiency.

- Tips for Effective Portfolio Scaling:

- Maintain a solid understanding of market trends and economic indicators.

- Focus on cash flow-positive properties that promise steady income.

- Diversify your portfolio across different types of real estate assets.

- Create a detailed business plan outlining your scaling strategy.

- Avoid over-leveraging; always have a buffer for unexpected downturns.

In conclusion, exiting at the peak and strategically scaling your real estate portfolio requires insight, patience, and bold moves. By mastering the art of timing the market for exits and employing savvy strategies for expansion, you're setting yourself up for unparalleled success in the real estate arena. Remember, every successful investor was once just someone with a plan who took decisive action. Now go out there and make your mark!