Florida housing market forecast 2024 Quiz

Test Your Knowledge

Question of

Overview of the Florida Housing Market

Current State of the Market

- Median Home Prices : The median home price in Florida has seen a significant increase over the past year, reflecting the high demand for housing in the state.

- Inventory Levels : Inventory levels in Florida are currently low, making it a seller's market. There are fewer homes available for sale than there are buyers, which has been driving up home prices.

- Sales Volume : Despite the low inventory, sales volume has remained robust, indicating a strong demand for homes in Florida.

Factors Influencing the Market

- Economic Indicators : The overall health of the economy, including job growth and consumer confidence, plays a significant role in the housing market's performance.

- Interest Rates : Interest rates are a critical factor affecting affordability and demand in the housing market. Lower rates can boost demand, while higher rates may cool it down.

- Population Growth : Florida continues to experience strong population growth, which drives demand for housing. The influx of new residents from other states and countries contributes to the competitive housing market.

Historical Market Trends

- Price Fluctuations Over the Past Decade : Over the past ten years, Florida's housing market has seen significant price fluctuations, with periods of rapid growth and adjustments.

- Recovery from Economic Downturns : The Florida housing market has shown resilience in recovering from economic downturns, bouncing back stronger after periods of decline.

- Comparison to National Housing Trends : Compared to national trends, the Florida housing market often experiences more pronounced fluctuations due to its unique economic and demographic factors.

Predictions for the Florida Housing Market in 2024

Expert Analysis and Forecasts

- Real Estate Economists' Opinions : Predict a gradual increase in housing prices, influenced by a steady demand and limited supply.

- Market Research Reports : Suggest a strong market for sellers, with buyers facing competitive conditions, especially in popular areas like Miami and Orlando.

- Historical Data Projections : Indicate a continuation of the upward trend in property values, though at a potentially slower pace than previous years.

Impact of Current Events

- Legislation Changes : New housing policies and tax reforms are expected to attract more investors, potentially increasing demand.

- Global Economic Influences : The state's market could be affected by international trade agreements and foreign investment patterns.

- Environmental Factors : Rising concerns over climate change and its impact on coastal properties may shift buyer preferences to inland locations.

Potential Market Disruptors

- Technological Innovations in Real Estate : Virtual reality tours and AI-driven property management tools could revolutionize how transactions are conducted.

- Shifts in Buyer Demographics : An increase in remote work may lead to a surge in demand from younger buyers looking for homes outside traditional urban centers.

- Changes in Housing Supply : Developments in construction technology and modular homes could help alleviate some of the housing shortages, stabilizing prices.

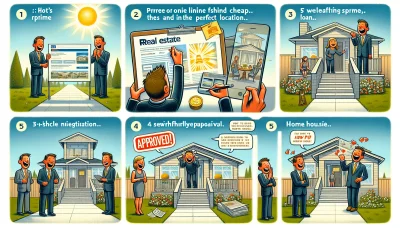

Buying a Home in Florida in 2024

Preparing for a Purchase

- Assessing Your Budget

- Understanding Mortgage Options

- The Importance of Pre-Approval

Searching for Properties

- Utilizing Online Resources

- Working with Real Estate Agents

- Attending Open Houses and Showings

Making an Offer and Closing the Deal

- Negotiation Strategies

- Home Inspections and Appraisals

- Closing Process and Costs

Selling a Home in Florida in 2024

-

Market Readiness Assessment

- Home Value Estimations

- Pre-Sale Home Improvements

- Timing the Market

-

Marketing Your Property Effectively

- High-Quality Listings

- Staging and Presentation Tips

- Leveraging Digital Marketing Tools

-

Closing the Sale Successfully

- Understanding Contract Terms

- Navigating Buyer Negotiations

- Finalizing the Transaction

Rental Market Projections for Florida in 2024

Demand for Rental Properties

- Population and Employment Trends : The continuous growth in Florida's population and employment sectors is expected to drive demand for rental properties, with particular emphasis on urban and suburban areas close to major employment centers.

- Tourism and Seasonal Rentals : Florida's robust tourism industry contributes significantly to the demand for short-term and seasonal rental properties, especially in coastal regions and near major attractions.

- Student Housing Needs : With numerous universities and colleges throughout the state, there is a consistent demand for student housing, presenting opportunities for rental property investors.

Investment Opportunities in Rentals

- Identifying Profitable Locations : Key to successful rental property investment is identifying locations with high demand, such as areas with growing employment opportunities, educational institutions, and tourist attractions.

- Long-Term vs. Short-Term Rentals : Investors should consider the benefits and challenges of both long-term and short-term rentals, including income potential, regulatory environment, and operational demands.

- Financial Analysis of Rental Investments : A thorough financial analysis, including cash flow, return on investment, and market trends, is essential for making informed investment decisions in the rental market.

Managing Rental Properties

- Finding and Screening Tenants : Effective strategies for finding and screening tenants are crucial for maintaining occupancy rates and ensuring reliable income from rental properties.

- Legal Considerations and Contracts : Understanding local laws, regulations, and creating solid rental agreements are key to protecting the interests of both landlords and tenants.

- Maintenance and Property Management : Regular maintenance and professional property management can help preserve property value and tenant satisfaction, contributing to the long-term success of rental investments.

Impact of Infrastructure and Development on Florida's Housing Market

-

Upcoming Major Projects

- Transportation and Transit Developments : New projects aim to enhance connectivity and reduce commute times across the state, potentially increasing property values in well-connected areas.

- Commercial and Retail Expansions : The expansion of commercial and retail spaces is expected to boost local economies and attract more residents to surrounding areas.

- Environmental and Green Initiatives : Sustainable development projects are being prioritized to protect Florida's natural landscapes, which may appeal to environmentally conscious homebuyers.

-

Urban Planning and Zoning Changes

- Smart City Innovations : Incorporation of technology in city planning is aimed at creating more efficient and livable urban environments, potentially increasing demand for housing in these smart cities.

- Residential Zoning Laws : Changes to zoning laws are facilitating the development of more diverse housing options, which could lead to a more dynamic real estate market.

- Community Impact Assessments : These assessments ensure that new developments contribute positively to existing communities, potentially making certain areas more attractive to buyers.

-

Investment Hotspots

- Emerging Neighborhoods : Areas undergoing significant development are becoming hotspots for investors looking for high growth potential.

- Waterfront Developments : Properties near water bodies remain highly sought after, with new developments enhancing their appeal.

- Urban vs. Suburban Growth : Both urban and suburban areas are experiencing growth, offering diverse opportunities for investors with different preferences.

Financing a Home in Florida's 2024 Market

Mortgage Rate Trends and Predictions

- Fixed-Rate vs. Adjustable-Rate Mortgages

- Federal Reserve Policies

- Lender Competition

Alternative Financing Options

- Government-Backed Loans

- Private Lending and Crowdfunding

- Lease-to-Own Agreements

Financial Planning for Homebuyers

- Saving for Down Payments

- Budgeting for Homeownership Costs

- Credit Score Improvement Strategies

Navigating Legal and Regulatory Changes in Florida Real Estate

Recent Legislation Affecting Homeownership

- Tax Laws and Incentives

- Insurance Requirements

- Building Codes and Standards

Understanding Real Estate Contracts

- Disclosure Obligations

- Contingency Clauses

- Title and Escrow Considerations

Protecting Your Real Estate Investments

- Asset Protection Strategies

- Risk Management through Insurance

- Estate Planning for Property Owners