Understanding home appraisals Quiz

Test Your Knowledge

Question of

Introduction to Home Appraisals

What is a Home Appraisal?

A home appraisal is a critical assessment of a property's value conducted by a professional appraiser. It's an unbiased evaluation that lenders require to ensure the home's market value supports the loan amount requested. An accurate appraisal safeguards both the lender and buyer from overinvesting in a property.

The purpose of an appraisal in real estate transactions is to give all parties confidence in the financial aspects of the deal. It differs from a home inspection, which focuses on the condition of the property, identifying repairs and potential issues, rather than its market value.

Purpose of Appraisal in Real Estate Transactions

Appraisals are vital for determining whether the home's contract price is appropriate considering its location, condition, and features. They play a crucial role in mortgage lending, often determining how much money a lender will offer to a borrower.

The difference between an appraisal and a home inspection can be significant. While both are important when buying or selling, an appraisal gives you an estimate of value, whereas an inspection identifies structural or mechanical issues.

Importance of Appraisals for Homeowners

For homeowners looking to refinance their mortgage, appraisals are indispensable. They can affect the interest rate offered and are often necessary to remove private mortgage insurance (PMI). A higher appraised value can lead to more favorable refinancing terms.

Appraisals also influence property taxes, as tax assessments are typically based on the appraised value. A higher appraisal means higher taxes, while a lower one could potentially reduce your tax burden.

The Appraisal Process Explained

The steps involved in a home appraisal include the examination of recent sales data for comparable homes in the area, an on-site visit to assess condition and features, and an analysis of current market trends. The final report reflects the estimated value of the property.

An appraisal is performed by a licensed or certified professional who has completed training and has knowledge of both real estate valuation and local market factors. Lenders often have approved appraisers they work with regularly.

- Research Local Sales: Compare similar recently sold properties to get preliminary insights into your home's potential value.

- Maintenance: Address any maintenance issues before the appraisal; even minor defects can negatively impact perceived value.

- Curb Appeal: Enhance your home's exterior appearance; first impressions can influence an appraisers assessment.

- Documentation: Provide documentation for any major improvements or upgrades made to your property; they may increase its appraised value.

- Cleanliness: Ensure your home is clean and decluttered; a tidy home can make it easier for an appraiser to see its full potential.

- Avoid Overinvestment: Be cautious about over-customization or overly ambitious renovations that might not appeal to the general market or reflect in the appraisal.

- Kitchen and Bathrooms: These areas often have significant impact on a homes value; consider updates here if possible.

- Understand Market Trends: Stay informed about local real estate trends as these will affect how your home is valued during an appraisal.

- Familiarize with Appraisal Standards: Knowing what appraisers look for can help you prepare effectively for their visit.

- Evidence-based Adjustments: If you believe your appraisal is too low, provide evidence such as comparables or overlooked features to contest it appropriately.

Preparing for a Home Appraisal

Enhancing Your Home's Appeal

A captivating first impression can significantly influence your home's appraisal value. It's crucial to declutter and clean every nook and cranny. A spotless, organized home not only looks appealing but also suggests that the property has been well-maintained.

Landscaping is another powerful tool in boosting curb appeal. Trimmed lawns and pruned shrubs present your home as a cared-for estate, potentially increasing its perceived value. Don't overlook this aspect when prepping for an appraisal!

Quick Fixes to Improve Value

Small repairs can lead to big returns. Fixing leaky faucets, patching up chipped paint, or replacing outdated hardware can make a world of difference. These quick fixes help create the impression of a well-kept home, which appraisers take note of.

Lighting upgrades are often undervalued yet vital. Bright, well-lit rooms appear more spacious and welcoming, which can subtly nudge the appraiser's valuation in the right direction. Make sure all bulbs are working and consider adding lamps to dark corners.

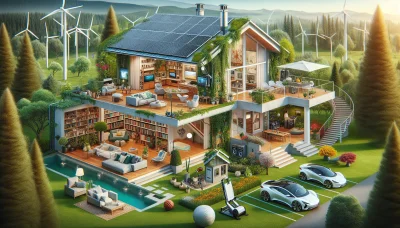

Long-Term Investments for Appraisal

Modernizing key areas like kitchens and bathrooms can substantially elevate your home's value. While these renovations require more investment, they typically offer solid returns during an appraisal due to their high impact on daily living quality.

Energy-efficient improvements are not just trendy; they're smart economics. Installing energy-efficient windows or upgrading insulation can reduce utility bills and increase your homes marketability, making them attractive features during an appraisal.

Documentation to Gather

When preparing for an appraisal, documentation is your best ally. Ensure you have all relevant paperwork neatly organized and ready to present. This demonstrates responsibility and preparedness that can reflect positively on your homes valuation.

Proof of Ownership and Property Deeds

Your property deed is a critical document establishing ownership. Have this on hand along with any co-ownership agreements or property transfer documents that provide a clear history of the homes ownership.

Records of Home Improvements and Repairs

- Maintain receipts and contracts from major renovations or additions.

- Compile before-and-after photos of improvement projects to visually demonstrate changes.

- Gather permits or city approvals for any structural changes made to the property.

- Create a detailed list of updates including dates and costs involved.

- Note any recent appliance upgrades or installations that contribute to the homes functionality.

- Keep a record of maintenance activities such as HVAC servicing or roof inspections.

Understanding Market Conditions

How Local Market Trends Affect Appraisals

The local real estate market plays a pivotal role in your homes appraisal value. An area experiencing growth with rising property sales can lead to higher appraisals due to increased demand. Stay informed about local trends as they might impact your valuation.

Comparing Recent Sales in Your Area

Analyze recent sales in your neighborhood for homes comparable to yours in size, condition, and features. These comparisons give insight into potential market values for your property, equipping you with knowledge that can be useful during the appraisal process.

Factors Affecting Home Value

Location and Neighborhood Dynamics

The adage "location, location, location" still stands as the pillar of home valuation. A prime location can dramatically increase a property's market value. Factors such as safety, local crime statistics, and overall neighborhood appeal are pivotal in determining desirability. Buyers are willing to pay a premium for a home that promises a better quality of life.

Proximity to local businesses, public transportation, and main thoroughfares plays a significant role in home valuation. Homes that offer easy access to these amenities often command higher prices. This convenience factor is a magnet for potential buyers seeking an efficient and comfortable lifestyle.

Proximity to Amenities and Services

Homes located near essential amenities like grocery stores, parks, hospitals, and shopping centers are more sought-after than those in isolated areas. These conveniences not only contribute to daily quality of life but also reduce travel time and expenses for residents. As urbanization increases, proximity to these services continues to be a strong selling point.

School District Ratings and Their Impact

A strong school district can be a game-changer in real estate values. Homes within the catchment area of highly-rated schools often have higher property values. For families with children, the quality of education is frequently a top priority. Even those without children recognize the value appreciation tied to excellent school districts.

Physical Characteristics of the Property

The age of a home can influence its value both positively and negatively. Historical homes may carry higher values due to their uniqueness and charm, while newer homes may boast modern conveniences that appeal to contemporary buyers. Size and layout considerations also play into the equation, with larger homes generally valued more if they are designed with efficiency in mind.

Maintenance is key; properties that have been well-cared-for usually maintain their value better than neglected ones. Structural integrity issues like foundation problems or a deteriorating roof can significantly diminish property value. Regular maintenance not only preserves but can also enhance a home's worth over time.

Age, Size, and Layout Considerations

The square footage of a home directly impacts its appraisal valuebigger often equals more expensive. However, beyond sheer size, the layout's functionality matters immensely. Open floor plans and flexible living spaces are currently in high demand for their ability to accommodate modern lifestyles.

Structural Integrity and Maintenance Issues

A sturdy structure free from significant maintenance issues is foundational to preserving home value. Buyers typically shy away from homes that require extensive repairs or show signs of neglect. It's crucial for homeowners to address any structural concerns promptly and ensure regular upkeep to support their investment's long-term growth.

Upgrades and Renovations

Retrofits and updates can significantly influence home value by bringing older properties up-to-date with current standards and tastes. However, it's important to assess which renovations will yield a return on investment (ROI). Not all improvements will increase home value proportionally to their cost.

Kitchens and bathrooms typically offer the best ROI when it comes to home renovations. Potential buyers often focus on these areas during their search because they are costly to upgrade later on. Simple cosmetic changes like paint or new fixtures can also make a substantial difference without breaking the bank.

Assessing the Value of Recent Renovations

- Analyze comparable sales in your neighborhood to determine which renovations are most beneficial financially.

- Consider energy-efficient upgrades that might attract buyers looking for homes with lower utility costs.

- Keep renovation styles neutral and widely appealing; highly personalized decor might deter potential buyers.

- Prioritize updates that address functional issues or add tangible comfort before aesthetic changes.

- Avoid over-improving beyond neighborhood standards as you may not recoup your investment upon sale.

Which Improvements Offer the Best ROI?

To maximize ROI on home improvements, focus on projects that enhance curb appeal firstfirst impressions matter! Landscaping improvements or an exterior paint job can significantly boost perceived value. Inside the house, minor kitchen remodels such as replacing countertops or refinishing cabinets provide substantial returns without requiring a full-scale renovation expense.

Common Misconceptions About Appraisals

Appraised Value vs. Market Value

There's often confusion between appraised value and market value, yet they serve different purposes. Appraised value is a professional assessor's estimation of a property's worth, while market value is what buyers are willing to pay. The appraised value is used primarily for lending purposes, whereas the market value reflects current real estate trends and buyer sentiment.

Understanding the distinction between these two values is crucial for buyers, sellers, and investors. The appraised value is determined by looking at various factors including location, condition, and recent sales of similar properties. Market value, on the other hand, can be influenced by factors like buyer demand and market conditions which are ever-changing.

Understanding the Distinction

It's important to realize that these values can diverge due to external factors. An appraiser might evaluate a property during a time when the market is particularly volatile, resulting in an appraised value that either overestimates or underestimates the actual sale price achievable in the current market.

How They Can Differ in a Volatile Market: In a rapidly changing market, discrepancies between appraised and market values are more common. This difference can pose challenges for financing and negotiations during property transactions.

The Role of the Homeowner During Appraisal

Homeowners often wonder how much influence they have over their property's appraisal. While you cannot directly affect the outcome, ensuring your home is clean and well-maintained can leave a positive impression on the appraiser.

Etiquette and Best Practices for Homeowners: Being courteous and providing easy access to all parts of your property will facilitate an efficient appraisal process. However, attempting to sway the appraiser's opinion can be seen as inappropriate conduct.

What You Can and Cannot Influence

- Documentation: Providing documents about recent improvements can help inform the appraisal.

- Maintenance: Addressing minor repairs before an appraisal may positively reflect on your propertys condition.

- Cleanliness: A clean home suggests well-maintained property but has no direct impact on value assessment.

- Persuasion: Direct attempts to influence the appraisers valuation are unethical and typically futile.

Myths About Selecting an Appraiser

A common myth is that homeowners get to select their own appraiser during a property transaction. In reality, the lender usually appoints an independent appraiser to ensure objectivity in the valuation process.

Who Chooses the Appraiser?

The selection of an appraiser is typically done by a lender through a third-party company. This approach prevents any potential conflicts of interest and maintains trust in the appraisal's impartiality.

The Independence of the Appraisal Process

Ensuring independence is paramount in real estate transactions. Industry regulations such as the Home Valuation Code of Conduct (HVCC) were established to protect this impartiality by prohibiting lenders direct influence over appraisers.

The Impact of an Appraisal on Financing

Loan-to-Value Ratio Explained

The Loan-to-Value (LTV) ratio is a critical factor lenders consider when determining the risk of a mortgage loan. It represents the proportion of the property's value that is financed through the loan, with a lower LTV indicating less risk for the lender.

A higher LTV ratio may lead to stricter lending requirements or higher interest rates as it increases the lender's exposure to potential loss. Understanding your LTV can help you assess your borrowing power and loan terms.

Importance in Mortgage Approval

Lenders scrutinize the LTV ratio to gauge mortgage approval chances. A favorable LTV often translates into easier approval processes, as it suggests substantial equity in the property, reducing default risk.

If your LTV exceeds certain thresholds, you might be required to purchase mortgage insurance, which protects the lender in case of default but adds to your monthly expenses.

Effect on Mortgage Insurance Requirements

Mortgage insurance becomes mandatory if your LTV exceeds 80%, safeguarding the lender's investment. This additional cost impacts your overall borrowing costs and monthly payments.

Reducing your LTV below this threshold by making a larger down payment or paying down principal can eliminate the need for mortgage insurance and save you money over time.

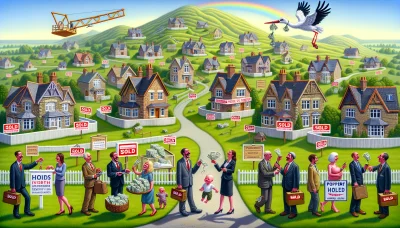

Dealing with a Low Appraisal

A low appraisal can derail financing plans by increasing the LTV ratio beyond what lenders find acceptable. It may necessitate renegotiation of the sale price or additional cash from buyers at closing.

- Challenge the Appraisal: Request a review if there are errors or missed comparisons.

- Rework Financing: Explore different lending options or mortgage products that may be more flexible with appraisal values.

- Negotiate with Sellers: Ask sellers to lower the price to match the appraised value if possible.

- Increase Down Payment: Reduce the financed amount by increasing your down payment to adjust the LTV ratio favorably.

- Look for Another Property: Sometimes walking away and finding a new property with better valuation might be more cost-effective.

Sellers facing a low appraisal may also need to consider lowering their asking price or offering concessions to keep deals moving forward.

Negotiating with Lenders or Parties Involved

Negotiations after a low appraisal involve discussions with lenders about loan terms or convincing parties involved to adjust their expectations. Creative solutions are often necessary to bridge valuation gaps and secure financing.

High Appraisal Outcomes

Benefits for Refinancing Opportunities

Leveraging Equity for Loans or Lines of Credit

Navigating Appraisal Disputes

Grounds for Contesting an Appraisal

When the stakes are high, and your property's valuation comes in question, knowing when to contest an appraisal is crucial. Common grounds for contesting include inaccuracies in the report and a valuation that doesn't reflect the current market conditions. It's essential to scrutinize the details, as even minor errors can significantly affect the outcome.

Identifying Errors in the Appraisal Report is a critical first step. Overlooking property features or incorrect data entry can skew results, leading to an unfair valuation. Homeowners should thoroughly review the report, keeping an eye out for mistakes in square footage, room count, or property condition.

Discrepancies in Comparable Sales Analysis can also lead to a flawed appraisal. The key is ensuring that the selected comparables are truly reflective of your home's value. Factors like location, size, condition, and sale date must be consistent; otherwise, it's a red flag that demands attention.

Steps to Challenge an Appraisal

If you're convinced that your appraisal is off-base, take action swiftly! Challenging an appraisal requires a methodical approach and gathering solid evidence to support your claim. Its not just about disagreeing with the value; its about proving why its incorrect.

How to Request a Reappraisal : Begin by contacting the lender or appraisal company to express concerns and request a second look. Be prepared with specifics vague complaints won't cut it. Articulate clearly which aspects of the report are in dispute and why they deserve another evaluation.

Compiling Evidence for an Appeal : This step is where you build your case. Collect recent sales data of comparable homes, note any discrepancies in property details, and if necessary, get statements from local real estate experts. Your goal is to create an irrefutable argument backed by concrete facts and figures.

Role of Appraisal Management Companies (AMCs)

In today's real estate landscape, Appraisal Management Companies (AMCs) play a pivotal role. They act as intermediaries between lenders and appraisers to ensure impartiality and compliance with regulations. Understanding their function can give you insights into navigating through appraisal disputes more effectively.

What AMCs Do in the Real Estate Industry : AMCs manage a network of qualified appraisers to fulfill appraisal orders from lenders while adhering to strict industry standards. Their mission is to maintain objectivity and fairness throughout the process a cornerstone principle in real estate transactions.

How They Handle Disputes and Quality Control : When disputes arise, AMCs become crucial players in quality control. They review contested appraisals for errors or oversights and enforce corrections if needed. Engaging with AMCs during a dispute can facilitate a thorough re-examination of your appraisal report.

- Tips for Engaging with AMCs:

- Maintain clear communication: Provide specific reasons for challenging the appraisal and articulate your concerns precisely.

- Gather substantial evidence: Before initiating a dispute, compile all relevant documentation such as comparable sales data and expert opinions.

- Understand their protocols: Familiarize yourself with the AMCs procedures for handling disputes to navigate the process effectively.

- Foster professionalism: Approach the situation professionally without letting emotions dictate communications or actions.

- Persistence pays off: If initial attempts don't yield results, don't hesitate to follow up while continuing to present new evidence.

Future of Home Appraisals in Real Estate

Technological Advancements in Appraising

The realm of home appraisals is undergoing a seismic shift, thanks to cutting-edge technology. With the advent of sophisticated software, appraisers can now analyze vast amounts of data, leading to more accurate and granular valuations. These tools help identify trends and patterns that were previously unnoticed, revolutionizing the precision of home valuations.

Automated Valuation Models (AVMs) are at the forefront of appraisal innovation, harnessing algorithms to estimate property values instantly. AVMs are transforming the industry by providing quick, cost-effective solutions that can be particularly useful for refinancing and home equity lines of credit. However, they also raise questions about accuracy when compared to traditional methods.

Use of Big Data and Analytics in Valuations

Big data is a game-changer in property appraisal. Analysts can now sift through immense datasets to extract relevant information for precise valuations. This data-driven approach allows for adjustments based on current market conditions and comparable sales, ensuring a nuanced understanding of a property's worth.

The Rise of Automated Valuation Models (AVMs)

The proliferation of AVMs has been nothing short of revolutionary. These models provide rapid value estimates which are essential in today's fast-paced market. Despite their advantages, it's crucial to acknowledge limitations such as lack of local market knowledge and the inability to factor in the unique characteristics of individual properties.

Regulatory Changes and Industry Standards

Legislation plays a pivotal role in shaping the appraisal process. Recent laws have been enacted to ensure greater transparency and fairness in real estate transactions. These regulations are designed to protect consumers by mandating thorough documentation and ethical valuation practices.

The global landscape significantly influences appraisal standards. Events like economic downturns or pandemics necessitate adaptations in appraisal methodologies to reflect changing market dynamics. Appraisers must stay informed and agile to maintain compliance with evolving standards.

Recent Legislation Affecting Appraisals

New legislation targeting real estate appraisals aims to fortify consumer trust and market stability. These laws often focus on enhancing appraiser qualifications, standardizing procedures, and promoting diversity within valuation methods to cater to an ever-changing real estate landscape.

Impact of Global Events on Appraisal Practices

Global events can cause dramatic shifts in appraisal practices. For instance, economic crises may lead to increased scrutiny on valuation processes, while environmental catastrophes could necessitate reevaluation of risk assessment criteria within appraisals.

Predicting Trends in Property Valuation

Eco-friendly features are increasingly influencing property values as sustainability becomes a priority for buyers. Homes equipped with energy-efficient systems or renewable energy sources are likely to command premium prices due to lower operating costs and growing environmental awareness among consumers.

Detecting market shifts is critical for anticipating changes in property valuation. Appraisers must consider factors such as demographic trends, economic indicators, and housing supply dynamics to predict future market behaviors accurately.

The Influence of Eco-Friendly Features on Value

Homes boasting green certifications or sustainable designs are not just trendy; they're proving to be sound investments. As eco-consciousness rises, properties with these features see increased demand, directly impacting their valuation positively.

Forecasting Market Shifts and Their Effects

To stay ahead of the curve, appraisers must hone their skills in forecasting market shifts. Recognizing patterns such as urbanization rates or telecommuting prevalence can provide insights into future demand variations across different property types and locations.

- Analyze historical data: Review past trends for insight into future changes in property valuation.

- Maintain flexibility: Be ready to adapt your appraisal techniques as new market information emerges.

- Prioritize continued education: Engage with ongoing professional development opportunities to understand emerging trends.

- Leverage technology: Utilize advanced tools like AVMs judiciously alongside traditional methods for well-rounded valuations.

- Evaluate global impact: Consider how international events might influence local real estate markets.

- Incorporate sustainability: Understand how eco-friendly features can add value to properties and reflect this in appraisals.

- Cultivate local expertise: Deepen knowledge about specific markets you serve for more precise valuations.

- Navigate regulatory changes: Stay updated on legislation affecting the industry for compliance and best practices.

Selling Your Home: Maximizing Appraisal Value

Timing the Market for Best Valuation

Understanding the real estate market's ebb and flow is crucial in determining when to sell your home. The right timing can significantly enhance your property's appraisal value. By analyzing market trends and seasonal demand, you can pinpoint the optimal selling period. This foresight can lead to a higher valuation, making it a strategic move for any seller.

Seasonal trends often dictate the pace of the real estate market, influencing both buyer behavior and home values. Typically, spring emerges as a prime time for sellers due to increased buyer activity, leading to potentially higher appraisal values. Conversely, winter might offer less competition but also fewer buyers, which could affect valuations.

Seasonal Trends in Real Estate Valuations

The seasons can have a profound impact on home appraisals. During spring and summer, properties tend to shine, inviting more foot traffic and competitive offers. Fall may see a dip as families settle into school routines, while winter traditionally cools off the market. Timing your sale with these trends in mind can maximize your home's appraisal value.

Economic Indicators to Consider Before Selling

Economic indicators are vital tools for gauging the best time to sell. Interest rates, employment statistics, and housing market forecasts provide insights into buyer purchasing power and demand. A robust economy usually translates into higher home appraisal values, making it imperative to stay informed on these indicators before listing your property.

Staging Strategies for Higher Appraisals

A well-staged home can captivate potential buyers and appraisers alike, often resulting in an elevated appraisal value. Staging allows you to showcase your home's best features while minimizing its flaws. This strategic presentation can make all the difference in securing a favorable valuation.

The Psychology Behind Staging a Home

Staging taps into the psychological aspects of buying by enabling potential buyers to envision themselves living in your space. A decluttered, neutral environment free from personal items allows for this mental transition. The strategic placement of furniture and decor enhances room flow and functionality, contributing positively to appraisal outcomes.

Key Areas to Focus on During Staging

- Curb Appeal: First impressions count! Enhance landscaping and exterior cleanliness to captivate interest immediately.

- Living Spaces: Create inviting areas that highlight comfort and usability with well-arranged furniture and warm lighting.

- Kitchen: Modern appliances and clutter-free countertops suggest a functional and updated space.

- Bathrooms: Ensure they are spotless with fresh towels and minimal personal items; consider minor updates for a fresh look.

- Neutral Colors: Use neutral paint colors to appeal to a broader audience and allow buyers to project their own ideas onto the space.

- Repairs: Address any maintenance issues beforehand; small fixes can prevent negative impacts on appraisals.

Negotiating Based on Appraisal Results

An appraisal not only establishes the value of your home but also serves as a powerful negotiating tool during the sale process. A higher-than-expected valuation bolsters your position, while a lower figure requires strategic adjustments. Understanding how to leverage this information is key in achieving your desired outcome.

Using the Appraisal in Sale Negotiations

In negotiations, an appraisal is instrumental in justifying your asking price. It provides concrete evidence of your home's worth that you can present to potential buyers or their agents. If the appraisal comes in high, it validates your pricing strategy; if low, be prepared with counterarguments or consider adjusting your expectations.

Handling Buyer Concerns Related to Appraisals

If an appraisal falls short of the agreed-upon sale price, it may raise concerns for both parties involved in the transaction. Sellers must be ready with persuasive arguments or flexible terms like price reduction or seller concessions. Addressing these issues head-on will help facilitate negotiations and keep the sale moving forward.