Florida housing market 2024 Quiz

Test Your Knowledge

Question of

Overview of the Florida Housing Market in 2024

Current Trends and Predictions

The Florida housing market is currently a whirlwind of activity, with trends showing a fascinating mix of highs and lows. Buyers and sellers are riding a rollercoaster of supply and demand that's influencing every decision. As we look ahead, it's clear that the market will continue to evolve, presenting new opportunities and challenges alike.

Price fluctuations are at the heart of the market's dynamics, with areas such as Miami and Orlando experiencing significant shifts. Whether you're looking to invest or find your dream home, understanding these patterns is key. The current trajectory suggests a continued rise in home values, but savvy market watchers are keeping an eye out for any signs of cooling.

Price Fluctuations and Market Dynamics

Market dynamics in Florida are as hot as its summer sun! Prices are soaring in sought-after coastal areas while inland markets offer more stability. Investors are particularly excited about the potential for growth in suburban neighborhoods as remote work continues to influence homebuying decisions.

In terms of price fluctuations, we're seeing a trend where luxury properties face steeper climbs compared to more modest homes. This stratification within the market underlines the importance of location and property type when considering investment potential in Florida real estate.

Influential Economic Factors

Economic factors are like the engine driving the Florida housing market train. Employment rates, interest rates, and population growth are all fueling this locomotive. With Florida's economy showing robust signs of health, there's a palpable sense of optimism among buyers and sellers.

However, it's not just local economics at play here; global events also cast their shadow on the Sunshine State's housing scene. International investors remain keenly interested in Florida properties, adding another layer of complexity to an already dynamic marketplace.

Expert Forecasts for 2024

Looking into our crystal ball for 2024, expert forecasts suggest that the Florida housing market will remain strong but nuanced. Analysts predict that while some regions may see a leveling off of prices, others could continue their upward trajectory due to factors like migration patterns and job growth.

The consensus among experts is clear: those considering entering the market should do so with both eyes open, ready to navigate the ebbs and flows that come with such a vibrant real estate landscape.

Impact of Recent Developments

Legislative Changes Affecting Real Estate

The legal landscape around real estate is always evolving, and recent legislative changes in Florida have made waves across the market. New regulations aimed at transparency and fairness are reshaping how transactions are conducted from Pensacola to Key West.

For instance, changes to tax laws and property insurance requirements have introduced new considerations for homeownership costs. Staying informed about these legislative updates is crucial for anyone involved in real estate transactions in Florida.

Infrastructure and Urban Planning

Florida's infrastructure projects are booming! From new highways to public transit developments, these initiatives promise to enhance connectivity across the state. This improved infrastructure is not only making travel easier but also opening up new areas for development.

- Road Expansions: Wider roads mean easier access to previously remote areas.

- Eco-Friendly Transit Solutions: Emphasis on sustainability is attracting environmentally conscious residents.

- Tech-Integrated Public Services: Smart city projects contribute to efficient living spaces.

- Zoning Reforms: These create opportunities for diverse property developments.

Technological Advancements in Property Management

The future is now when it comes to property management technology! Innovations such as AI-driven analytics tools are revolutionizing how properties are marketed and managed. This tech wave promises greater efficiency and insights for investors and homeowners alike.

Buying Property in Florida: What to Expect in 2024

Navigating the Buying Process

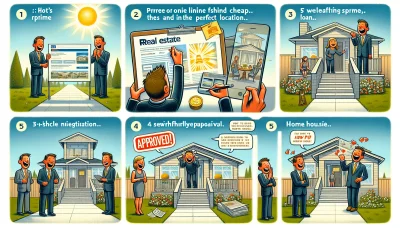

Embarking on the property-buying journey in Florida can be exhilarating! As 2024 approaches, the market is brimming with opportunities. It's crucial to have a clear roadmap, starting with comprehensive research and planning. Stay ahead of the game by familiarizing yourself with market trends and forecasts.

Understanding local real estate laws is non-negotiable. They vary from county to county, affecting everything from zoning regulations to tax implications. This knowledge can be the difference between a smooth transaction and a legal headache. Ensure you're well-versed in these nuances for a seamless buying experience.

Understanding Local Real Estate Laws

Florida's real estate laws are unique, with specifics on disclosures, homestead exemptions, and more. Engage with a knowledgeable attorney who specializes in Florida property law. They will be pivotal in navigating complex legal terrain and safeguarding your interests.

Finding the Right Real Estate Agent

The right real estate agent is your ally, guiding you through the labyrinth of listings and negotiations. Opt for an agent with a proven track record in Florida's market. Their insights into local nuances and network can unlock doors to exclusive listings and opportunities.

Securing Financing and Mortgages

Financing is the cornerstone of your property acquisition strategy. In 2024, anticipate shifts in mortgage rates and lending criteria. Start early by assessing your financial health and gathering necessary documents. A pre-approval letter can give you a competitive edge when making an offer.

Identifying Growth Areas and Hotspots

Dive into the dynamic landscape of Florida's real estate to pinpoint growth areas that promise lucrative returns. Analyze economic indicators, infrastructural developments, and demographic trends. These factors are telling signs of a neighborhood's growth trajectory.

Analyzing Neighborhood Potential

Don't just dream about sunny skies and sandy beaches; get granular with neighborhood potential! Scrutinize local schools, crime rates, and community amenities. These elements significantly impact property values and livability.

Up-and-Coming Locations for Investment

- Research Thoroughly: Dig deep into market reports, news articles, and economic forecasts to identify burgeoning areas.

- Visit In Person: Nothing beats firsthand experiencevisit neighborhoods to get a true feel for the community vibe.

- Talk to Locals: Engage with residents for insider perspectives on neighborhood dynamics.

- Leverage Technology: Utilize online tools and platforms for virtual tours and property histories.

- Monitor Development Plans: Stay informed about upcoming infrastructure or commercial projects that could boost property values.

- Prioritize Accessibility: Consider proximity to transport links, which is often a hallmark of desirable locations.

- Diversify Your Options: Spread your interests across different areas to mitigate risks associated with regional market fluctuations.

- Avoid Impulse Buying: Resist the temptation of speculative investments without solid data backing your decision.

Evaluating Coastal vs. Inland Opportunities

The coastal versus inland debate is hot among investors! Coastal properties often command higher prices due to their allure but consider risks like erosion or hurricanes. Inland may offer more stability and growth potential as urban sprawl continuesweigh these factors carefully!

Selling Your Florida Home in 2024

Preparing Your Home for Sale

Entering the real estate market in Florida is exhilarating, and preparing your home for sale is the first crucial step. You want to ensure that it looks inviting and well-maintained, which increases its appeal to potential buyers. Start by decluttering each room to make spaces appear larger and more welcoming.

After decluttering, focus on deep cleaning. Sparkling windows, polished floors, and a fresh coat of paint can work wonders. Remember, first impressions are everything; a clean, fresh-smelling home suggests that it's been cared for, making it more attractive to buyers.

Home Staging and Presentation Tips

Staging your home is about highlighting its strengths and downplaying any weaknesses. Furnishings should complement each space without overwhelming it. Aim for a neutral decor as it helps potential buyers envision themselves living there. Enhance natural light wherever possible it makes your home feel more open and airy.

- Declutter: Remove personal items and excess furniture.

- Clean: A spotless environment suggests a well-maintained home.

- Neutralize: Choose neutral colors for walls and furnishings.

- Accentuate: Use accents to draw attention to your home's best features.

- Freshen Up: Add plants or flowers for a touch of nature.

- Maintenance: Ensure all fixtures and fittings are in working order.

Necessary Repairs and Upgrades

Tackling necessary repairs before listing can significantly boost your homes value. Fix leaky faucets, patch holes in walls, and address any HVAC issues. Upgrades need not be extensive; even small improvements like modern hardware on cabinets or updated lighting fixtures can make a big impact on buyers perceptions.

Setting a Competitive Asking Price

Pricing your home appropriately is criticalit can mean the difference between attracting multiple offers or having your property linger on the market. Analyze the local market trends, assess comparable sales in your area, and consider hiring an appraiser to get an objective valuation of your property's worth.

Marketing Strategies for Maximum Exposure

In today's digital age, an online presence is indispensable when selling your home. High-quality photos and virtual tours are essential components of an effective listing. Use social media platforms to boost visibility, targeting local real estate groups where prospective buyers might be lurking.

Utilizing Online Platforms Effectively

Leverage popular real estate websites by listing your property with compelling descriptions that highlight unique features. Don't forget the power of video; creating a walk-through video can give prospects a better sense of space than photos alone.

Hosting Open Houses and Private Showings

An open house can generate buzz and attract multiple interested parties at once. It allows buyers to explore at their own pace and envision their future in the space. Private showings should also be accommodated; they offer a more personalized viewing experience which some buyers prefer.

Networking with Local Agents and Buyers

Cultivating relationships with local real estate agents can lead to more exposure for your property. Agents often have clients ready to buy. Additionally, consider reaching out directly to local buyer pools through community events or targeted advertising campaigns these direct connections can pay off immensely!

Rental Market Insights for Florida in 2024

Understanding Tenant Demographics

The tenant landscape in Florida is as diverse as its sunny beaches and vibrant cities. Understanding who's renting is crucial to maximizing your property's appeal. From young professionals flocking to Miami's dynamic job market to retirees seeking the serene coastal life, each group has distinct needs and preferences.

Millennials and Gen Zers are dominating the rental scene, drawn by tech hubs and cultural hotspots. They prioritize locations with connectivity and amenities. Meanwhile, baby boomers are downsizing but still demand quality and convenience. Knowing these trends helps tailor your marketing strategies effectively.

Catering to Different Age Groups

To appeal to younger tenants, emphasize smart-home features and flexible spaces that can double as home offices. For older residents, focus on security, accessibility, and community aspects of your properties. Highlighting these features in your listings can significantly increase interest among targeted age groups.

It's not just about age; lifestyle preferences play a huge role too. Urban properties should boast about proximity to nightlife and public transport, while suburban homes can highlight local schools and family-friendly parks.

Attracting Long-Term vs. Short-Term Tenants

Long-term tenants provide stability and reduced turnover costs. To attract them, consider offering incentives like rent discounts for extended leases or personalized upgrade options. Build a sense of community to encourage longer stays.

Short-term rentals cater to tourists or business travelers and require a different approach. Focus on fully furnished units with all-inclusive services. Partnering with local businesses can enhance the attractiveness of your short-term offerings.

Meeting the Needs of a Diverse Population

Florida's cultural diversity means your rental strategy must be inclusive. Offer multilingual support and consider cultural sensitivities in your property design and amenities. This broadens your market reach and positions you as a landlord of choice.

Adaptability is key; flex spaces that can serve various functions from home gyms to remote learning centers cater to diverse lifestyles and needs, making your property stand out in the competitive Florida rental market.

Profitability and Investment Analysis

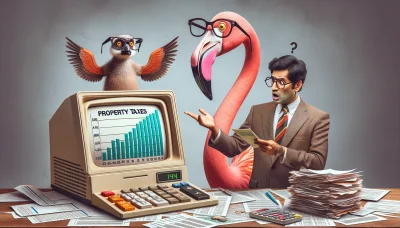

Calculating Return on Investment (ROI)

- Consider both capital appreciation and rental income when calculating ROI.

- Factor in expenses such as maintenance, taxes, insurance, and vacancy rates.

- Use conservative estimates for rental increases to avoid overestimating future returns.

- Analyze comparable properties in the area for a realistic assessment of potential ROI.

- Remember that ROI can improve over time as you build equity and potentially increase rents.

- Consult with financial advisors or real estate experts for a thorough evaluation.

- Stay informed about local economic trends that could impact your investment.

- Keep meticulous records of all expenses and income for accurate ROI calculations.

- Consider leveraging technology tools or platforms for efficient property management.

- Avoid emotional investments; rely on data-driven decisions to maximize ROI.

Assessing Rental Yield and Cash Flow

To ensure profitability, savvy investors scrutinize rental yields the annual rental income as a percentage of the property's cost. High yields signal strong cash flow potential but beware of areas where high yields come from declining property values rather than genuine income strength.

Cash flow is king in rental investments. Positive cash flow means your property earns more than it costs to maintain, creating a buffer against market fluctuations. Careful budgeting for both expected costs and potential surprises will keep you cash flow positive.

Considering Property Management Services

Hiring a property manager can streamline operations but at a cost that affects your bottom line. Weigh the benefits of professional management against the expense to determine if it's right for your investment strategy.

If you decide on professional management, select a firm with proven expertise in Florida's market. They should optimize occupancy rates while handling day-to-day operations efficiently, leaving you free to focus on strategic investment decisions.

The Role of Technology in Florida's Real Estate Market

Advancements in Property Search and Viewing

Technology has revolutionized the way we search for homes, with online listings now the norm. In Florida, a hotbed for real estate, buyers can filter searches by price, location, and features effortlessly. From the comfort of their homes, they can access a wealth of information that was once available only through agents.

Virtual tours and augmented reality experiences are game-changers. Potential buyers in Florida can now walk through properties virtually, getting a feel for the space without physical visits. This is incredibly convenient and saves time, especially for out-of-state investors eyeing Florida's lucrative market.

Virtual Tours and Augmented Reality Showings

Florida's real estate agents are embracing virtual reality to offer immersive property experiences. These technologies enable vivid property previews, crucial during times when travel or personal interactions are limited. Augmented reality apps also allow users to visualize changes and furnishing in prospective homes.

Online listing platforms and mobile apps have become indispensable. They provide up-to-the-minute inventory updates and notifications on market trends. This empowers buyers and sellers in Florida with data previously exclusive to real estate professionals.

Online Listing Platforms and Mobile Apps

The rise of mobile technology has put real estate transactions at our fingertips. In Florida, where the market moves quickly, being able to access listings on-the-go gives buyers an edge. Sellers benefit from broader exposure and analytics that help them understand buyer behaviors.

AI-powered price valuation tools are transforming market analysis. These tools analyze vast data sets to predict prices with impressive accuracy, helping both buyers and sellers in Florida make informed decisions. This tech-driven approach removes much of the guesswork involved in pricing properties.

Streamlining Transactions and Paperwork

The days of physical paperwork in real estate transactions are fading fast. E-signing solutions offer secure, legal signatures on contracts without the need for face-to-face meetings. In Floridas fast-paced market, this speeds up deals significantly.

Digital transaction management systems are simplifying the buying process. These automated systems track each step of a transaction, ensuring nothing is missed while saving time for all parties involved in Florida's real estate deals.

E-Signing and Digital Contracts

- Convenience: Sign documents from anywhere at any time.

- Speed: Transactions move faster without waiting for physical signatures.

- Security: Digital signatures often have tracking and authentication methods that enhance security.

- Eco-Friendly: Reduces paper waste contributing to environmental sustainability.

- Error Reduction: E-signatures reduce the risk of missing signatures or misplaced documents.

- Storage & Retrieval: Electronic storage makes it easy to keep track of contracts without physical filing systems.

- Legal Recognition: E-signatures have legal standing similar to traditional signatures under laws like ESIGN Act.

- Mistakes to Avoid: Ensure compatibility across all stakeholders' devices; verify the legality within your jurisdiction; maintain backups; choose reputable e-signing providers.

Automated Transaction Management Systems

Incorporating automated systems into transactions reduces human error and enhances efficiency. Real estate professionals across Florida leverage these systems to monitor deadlines, manage documentation, and coordinate with all parties involved seamlessly.

Blockchain for Secure Record Keeping

The potential of blockchain in real estate is vast, particularly when it comes to security and transparency in transactions. In Florida's dynamic market, blockchain can provide immutable records of ownership, clear title transfers, and streamline payment processesushering in a new era of trust in real estate dealings.

Financing and Mortgage Trends in Florida for 2024

Exploring Mortgage Options and Rates

As we dive into the vibrant world of Florida's real estate, the array of mortgage options available is truly impressive. Fixed-rate mortgages remain a popular choice, offering the security of constant monthly payments. On the other hand, adjustable-rate mortgages (ARMs) are enticing with their initial lower rates, which can be particularly attractive to those expecting an increase in future income.

The landscape of government-backed loans is ever-evolving, presenting a suite of programs that cater to first-time homebuyers and veterans alike. These programs often feature more lenient credit requirements and smaller down payments, making homeownership accessible to a broader audience in Florida's bustling market.

In an era of innovation, private lending and alternative financing methods have emerged as game-changers. These avenues open doors for those who may not fit the traditional borrower mold, offering flexibility and creative solutions that challenge conventional banking norms.

Fixed-Rate vs. Adjustable-Rate Mortgages

The choice between fixed-rate and adjustable-rate mortgages boils down to one's appetite for risk versus stability. Fixed-rate mortgages are like a rock in turbulent seas, unswayed by market fluctuations, perfect for those who crave predictability in their financial planning. Conversely, ARMs are akin to sails on a swift vessel, capturing the winds of low introductory rates to offer potentially lower costs upfront.

Yet with ARMs comes the caveat of potential rate increases over time, a thrilling gamble that can lead to increased monthly payments. Borrowers must weigh this against the backdrop of their long-term plans whether they foresee selling or refinancing before rates adjust could tip the scales in favor of an ARM.

Government-Backed Loans and Programs

Federal initiatives such as FHA loans, VA loans, and USDA loans shine brightly as beacons of hope for many aspiring homeowners in Florida. With benefits like reduced down payment requirements and more forgiving credit score criteria, these programs are pillars supporting the American Dream.

- FHA Loans: Ideal for low-to-moderate-income borrowers; require as little as 3.5% down.

- VA Loans: Exclusive to veterans and active military members; offer zero down payment options.

- USDA Loans: Targeted at rural property buyers; provide 100% financing with no down payment required.

It's key to note that each program has unique qualifications that must be met. Potential borrowers should consult with mortgage professionals to understand which program best aligns with their financial situation and homeownership goals.

Impact of Economic Policies on Borrowing

The Federal Reserve wields considerable influence over borrowing costs through its monetary policy decisions. An increase in interest rates can dampen borrowing enthusiasm by driving up mortgage costs but can also signal a strengthening economy. Conversely, rate cuts aim to stimulate borrowing but may indicate concerns about economic growth.

Credit scores stand as gatekeepers in the realm of borrowing qualifications. A high credit score can unlock favorable interest rates and terms, while lower scores may necessitate higher interest rates or additional fees or even result in a loan denial.

Federal Reserve Decisions on Interest Rates

The ever-watchful eye of the Federal Reserve on inflation and economic performance results in adjustments that ripple across mortgage landscapes. When interest rates ascend, monthly mortgage payments follow suit, urging borrowers to carefully consider timing when entering the market or refinancing existing loans.

Credit Score Requirements and Qualifications

In this dynamic financial environment, maintaining a robust credit score is paramount. Lenders scrutinize these scores to assess risk a high score might mean access to premium loan products with lower interest rates; conversely, a lower score could limit options or necessitate higher down payments.

The Influence of Global Economic Events

We live in an interconnected world where global economic events wield power over local mortgage rates. From trade agreements to international conflicts, these occurrences can sway investor behavior resulting in rate fluctuations that impact how much Floridians pay for their homes.

Legal and Regulatory Considerations in 2024's Florida Real Estate Market

Staying Compliant with State Regulations

The Florida real estate market in 2024 is teeming with potential, but it's crucial to stay aligned with state regulations. Developers and investors must be vigilant, ensuring that their projects comply with a dynamic regulatory landscape. This vigilance protects against legal pitfalls and fosters a trustworthy market environment.

As the market evolves, so do the laws governing it. Keeping abreast of legislative changes is not just recommended; it's essential for success. Real estate professionals should prioritize regular consultations with legal experts to navigate this ever-changing terrain confidently.

Understanding Zoning Laws and Restrictions

Zoning laws are the cornerstone of property development in Florida. They dictate land use and are pivotal in shaping community layouts. Ignoring these laws can lead to costly delays or even project cancellations, so comprehensive understanding is paramount.

Prospective developments hinge on the intricacies of zoning restrictions. These frameworks are designed to ensure that land use aligns with community plans and infrastructure capabilities. Mastery of zoning details is a non-negotiable aspect of real estate development in 2024.

Navigating the Permitting Process

The permitting process can be intricate, but its successful navigation is a hallmark of real estate proficiency. Permits are safeguards, ensuring that structures meet safety and design standards. The process may seem daunting, but it's integral to responsible property development.

Gaining permits is a step-by-step journey requiring patience and attention to detail. Real estate players should approach this process methodically, securing all necessary documentation to avoid any roadblocks that could derail their projects.

Adhering to Fair Housing Laws

Fair Housing Laws are non-negotiable ethical pillars in the real estate sector. These laws promote equality and protect against discrimination. Compliance is not only a legal mandate but also a moral imperative, reflecting the integrity of the property market.

Real estate entities must ensure that their practices align with Fair Housing principles. This alignment guarantees an inclusive market where opportunity is not marred by prejudice, thus fostering a diverse and vibrant community landscape.

Environmental and Climate-Related Issues

In 2024, Florida's real estate market cannot turn a blind eye to environmental considerations. With climate change at the forefront, developers must integrate sustainability into their projects. This foresight mitigates environmental impact and appeals to eco-conscious buyers.

The state's unique ecosystem necessitates environmentally attuned development strategies. By prioritizing green initiatives, real estate stakeholders can lead by example, setting new industry standards for environmental responsibility in property development.

Building in Flood Zones and Coastal Areas

- Elevate Structures: Raising buildings above flood levels reduces risk and potential damage.

- Incorporate Flood Barriers: Implementing physical barriers can deflect water away from valuable properties.

- Select Resilient Materials: Choosing materials resistant to water damage ensures longevity in harsh conditions.

- Plan for Drainage: Effective drainage systems are critical in managing floodwaters during severe weather events.

- Maintain Insurance: Securing comprehensive flood insurance offers financial protection against unforeseen disasters.

- Familiarize with FEMA Guidelines: Understanding FEMA's regulations helps maintain compliance and secure funding if needed.

- Engage Local Experts: Local architects and engineers have valuable insights into region-specific construction techniques for flood-prone areas.

- Prioritize Environmental Impact Assessments: Conducting thorough assessments minimizes ecological disruption and aligns with regulatory requirements.

Adapting to Climate Change Regulations

New regulations emerge as Florida adapts to climate realities; staying ahead means integrating adaptive features into building designs. Proactive adaptation not only ensures regulatory compliance but also enhances property value resilience over time.

The savvy investor recognizes that climate change regulations present opportunities for innovation. By embracing these changes, one can position themselves as a leader in sustainable development, attracting clients who value forward-thinking approaches to real estate investment.

Investing in Sustainable and Resilient Properties

Sustainability is no longer just a buzzword; it's a competitive edge in today's market. Properties designed with resilience against climate risks stand out, offering buyers peace of mind and potentially higher returns on investment due to lower operating costs and increased demand for eco-friendly options.

The trend towards sustainable living spaces continues to gain momentum in 2024, making green investments more than just an ethical choicethey're a strategic business decision. By investing in properties that prioritize sustainability, developers can tap into a growing demographic seeking environmentally responsible living solutions.