Down payment assistance programs arizona Quiz

Test Your Knowledge

Question of

Understanding Down Payment Assistance in Arizona

Eligibility Requirements for Assistance Programs

Unlocking the doors to homeownership in Arizona can be easier with down payment assistance programs. These programs are designed to help first-time and repeat homebuyers by providing financial support for down payments and closing costs. To be eligible, applicants must meet specific criteria, which often includes taking a homebuyer education course.

The eligibility for these programs is not just open-ended; there are targeted income limits and qualifications that must be met. These income limits are usually set as a percentage of the area median income (AMI) and can vary depending on the size of your household and the county in which you're planning to purchase a property.

Income Limits and Qualifications

Income limits for assistance programs in Arizona are established to ensure that aid is given to those who need it most. The exact income thresholds depend on the specific program and location within the state. Generally, applicants must fall within low to moderate-income brackets to qualify.

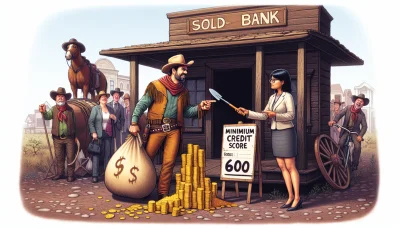

Credit Score and Financial Prerequisites

Your credit score plays a pivotal role in determining your eligibility for down payment assistance. A decent credit score signifies responsible financial behavior, which is a green light for lenders and assistance programs alike. Additionally, some programs may require a minimum level of personal investment in the home purchase, ensuring that buyers have "skin in the game."

Types of Down Payment Assistance

Down payment assistance in Arizona comes in various forms, each with its own set of rules and benefits. Understanding these differences is key to finding the right kind of help for your home purchase journey.

Grants vs. Loans

Grants are like a financial gift; they don't need to be repaid if you comply with all program requirements, making them an attractive option for many buyers. On the other hand, loans must be repaid, but they often come with favorable terms such as low interest rates or deferred payments.

Forgivable, Deferred, and Repayable Options

- Forgivable: These loans may be forgiven over a certain period of occupancy, effectively turning into a grant if you remain in the home for that duration.

- Deferred: Payments on these loans are postponed until certain events occur, such as the sale or refinancing of the home.

- Repayable: This type requires regular payments from day one or after an initial grace period has passed.

How to Apply for Assistance

The application process for down payment assistance can seem daunting, but breaking it down into steps makes it manageable. Start by researching available programs in Arizona and their specific requirements.

Application Process Overview

To apply for down payment assistance, begin by contacting an approved lender or housing counseling agency. They will guide you through the pre-approval process and provide details on how to proceed with your application. Be prepared; competition can be fierce, so getting started early is crucial!

Required Documentation and Deadlines

Gathering necessary documentation is essential when applying for down payment assistance. This typically includes tax returns, pay stubs, employment verification, and bank statements. Pay close attention to deadlines missing one could delay your application or cause you to miss out entirely on available funds.

Exploring Arizona's Home Buyer Programs

Arizona's home buyer programs offer a treasure trove of resources and financial support designed to help a variety of prospective buyers achieve their dream of homeownership. These programs are tailored to assist individuals based on their profession, military service, or first-time buyer status.

With competitive interest rates, down payment assistance, and mortgage credit options, Arizona's initiatives are transforming the home buying landscape. Navigating through these programs reveals opportunities for substantial savings and support throughout the purchasing process.

First-Time Home Buyer Special Programs

Benefits for First-Time Buyers

First-time home buyers in Arizona can access incredible benefits like reduced interest rates and down payment assistance. These incentives make it easier to purchase a home by reducing upfront costs and ongoing mortgage payments.

Many programs also offer educational resources to guide new buyers through the complexities of purchasing a property, ensuring they make informed decisions. This foundational knowledge is key to navigating the real estate market with confidence.

Targeted Areas and Special Conditions

Arizona places particular emphasis on revitalizing certain areas through its targeted programs, which provide additional benefits if you buy in these locations. These might include larger assistance amounts or more favorable loan terms.

To qualify for these enhanced benefits, buyers often need to meet specific income limits and purchase properties within designated price ranges. This focus on targeted areas aims to encourage growth and investment in communities that need it most.

Veterans and Military Down Payment Support

VA Loans and Benefits

Veterans in Arizona have access to VA loans offering competitive interest rates with no down payment requirement. These loans can remove significant financial barriers to homeownership for those who have served our country.

In addition, VA loans do not require private mortgage insurance (PMI), which can lead to substantial cost savings over the life of the loan. This benefit alone can make homeownership much more affordable for veterans.

Additional State-Specific Support for Veterans

Beyond federal VA loan benefits, Arizona provides state-specific support systems for veterans including down payment assistance programs and educational resources tailored to their unique needs.

This additional layer of support ensures that veterans in Arizona are well-equipped with the tools they need to transition into homeownership smoothly and sustainably.

Programs for Public Service Employees

Teachers, Firefighters, and Police Officers Programs

Arizona honors its teachers, firefighters, and police officers with special home buying programs that recognize their service to the community. Reduced interest rates and down payment assistance are just some of the perks available.

The Home in Five Advantage program is one such initiative that boosts public servants' purchasing power by offering them substantial financial aid when buying a home within Maricopa County.

Healthcare Workers Homeownership Initiatives

- Mortgage Assistance: Programs may offer lower interest rates or down payment assistance specifically for healthcare workers.

- Educational Workshops: Free or low-cost workshops about the home-buying process are often available to healthcare professionals.

- Favorable Loan Terms: Certain programs might feature beneficial loan terms like reduced fees or flexible credit requirements tailored for healthcare workers.

The Role of Credit in Securing Down Payment Help

Building a Strong Credit History

Your credit history is the backbone of your financial profile! Lenders scrutinize it to determine your loan eligibility for down payment assistance. A solid credit history can open the doors to favorable loan terms and a variety of assistance programs. It's like having a VIP pass in the world of finance!

Think of your credit report as your financial fingerprint. It tells lenders exactly how you manage money. A clean report with on-time payments and low credit utilization rates sends a message that you're a reliable borrower. It's your ticket to potentially lower interest rates and better borrowing conditions!

Steps to Improve Your Credit Score

Improving your credit score is like embarking on a quest for financial glory! Start by reviewing your credit report for errors and dispute any inaccuracies. Then, focus on paying down outstanding debt and keeping your credit card balances well below their limits. Remember, this isn't an overnight journey, but the rewards are monumental!

Stay vigilant with bill paymentslate payments are the archenemies of good credit scores! Keep older accounts open to extend your credit history length, showing you've been at this game for a while. And limit new credit inquiries; too many can make lenders think you're desperate for cash.

How Credit Impacts Loan Terms

Credit scores are like keys that unlock different levels of loan conditions. High scores can lead to lower interest rates, smaller down payments, and more flexible loan terms. In essence, they can significantly reduce the total cost of purchasing a home over time.

If you've got stellar credit, lenders might roll out the red carpet with premium loan products designed just for you! Conversely, lower scores might mean higher costs or even closed doors when it comes to securing down payment help. So aim high with your credit score and watch those doors swing open!

Overcoming Credit Challenges

Don't let bad or insufficient credit history be the villain in your homeownership story! There are ways to overcome these hurdles and still get assistance with your down payment. It might take some strategic planning and patience, but it's absolutely doable.

Dealing with Bad or Insufficient Credit History

- Analyze Your Situation: Get a complete picture of where you stand by obtaining your credit report from all three major bureaus.

- Create a Budget: Carefully plan your finances to ensure timely bill payments and avoid taking on more debt than necessary.

- Reduce Debt: Focus on paying off high-interest debts first to reduce overall interest payments and improve your debt-to-income ratio.

- Become an Authorized User: Being added to a family member's account with good standing can help bolster your own credit record.

- Negotiate with Creditors: Sometimes you can arrange for a settlement or payment plan that benefits both parties.

- Credit Builder Loans: These loans help build credit when traditional lines may not be available or advisable.

- Professional Advice: Consider seeking help from a reputable credit counselor who can guide you through tailored strategies.

- Persistence is Key: Stay consistent with good financial habits; rebuilding credit takes time but is worth the effort.

Alternative Financing Options for Low Credit Scores

If traditional loans seem out of reach due to low credit scores, fear not! Alternative financing options exist such as FHA loans, which have lower requirements, or various state and local assistance programs designed specifically for buyers like you. The key is researchleave no stone unturned in seeking out these opportunities!

Sometimes private lenders or seller financing arrangements offer more flexibility than traditional banks. Crowdfunding platforms have also emerged as innovative ways to gather down payment funds without conventional loans. Explore every avenue; there's likely an option that fits your unique situation!

Budgeting for a Home Purchase with Assistance Programs

Calculating the Total Cost of Homeownership

Understanding the full spectrum of homeownership costs is crucial before taking the leap. It's not just about the price tag on the house; it encompasses mortgage interest, maintenance, renovations, and utility costs. Prospective buyers must calculate these expenses to gauge affordability accurately.

When exploring assistance programs, it's imperative to factor in their impact on your overall financial commitment. These programs can significantly reduce upfront costs through down payment aid or closing cost assistance. However, they may also come with long-term considerations like income-based repayment plans or residency requirements.

Estimating Mortgage Payments with Assistance

Mortgage calculators are a godsend for prospective buyers, offering a glimpse into future monthly payments. When using these tools, input any assistance program benefits to see their effect on your mortgage. This will paint a clearer picture of your financial obligations post-purchase.

Assistance programs may adjust your mortgage payments by offering lower interest rates or subsidizing a portion of the loan. Keep in mind that while this can ease initial payments, it might extend the loan's term or change the type of mortgage you qualify for.

Additional Costs to Consider (Insurance, Taxes, etc.)

Homeownership goes beyond mortgage payments; insurance and taxes wait just around the corner. Property taxes can fluctuate based on location and home value, while homeowner's insurance rates depend on property risk factors. Always include these in your budget forecasts.

Don't overlook ongoing maintenance and emergency repairs these can be significant over time. Setting aside funds monthly for these 'hidden' homeownership costs can prevent financial strain later on.

Saving Strategies for Future Homeowners

To turn your homeownership dream into reality, a robust saving strategy is non-negotiable. Start with creating a detailed budget to identify potential savings areas every penny counts when you're saving for a down payment!

Effective Budgeting Techniques

- Analyze Your Spending: Track where every dollar goes to find savings opportunities.

- Cut Non-Essential Expenses: Reduce discretionary spending like dining out or subscription services.

- Prioritize Savings: Treat your savings account like a bill that must be paid each month.

- Automate Transfers: Set up automatic transfers to your savings account to ensure consistent contributions.

- Rewards Programs: Utilize cashback and rewards programs for everyday purchases and funnel those savings directly into your home fund.

- Negotiate Bills: Regularly review service contracts (internet, phone) and negotiate better rates or switch providers if necessary.

- Earn Extra Income: Consider side gigs or sell unused items for an additional funds boost.

- Avoid Debt: Steer clear of high-interest debt that can hamper your saving efforts.

Long-Term Savings Plans and Accounts

Crafting a long-term saving strategy is essential for accumulating enough capital for home purchase. High-yield savings accounts, certificates of deposit (CDs), and government bonds can offer safe havens for growing your down payment fund with minimal risk.

Managing Existing Debt

Your debt-to-income ratio plays a pivotal role in mortgage approval. Lenders scrutinize this figure to determine your borrowing capacity. Strive to minimize existing debt before applying for a mortgage to enhance your qualification chances and secure better terms.

Debt-to-Income Ratio Importance

The debt-to-income ratio is decisive in home buying it influences both eligibility and affordability. A high ratio suggests financial overextension, potentially deterring lenders. Aim for a low ratio to present yourself as a responsible borrower with room for new debt obligations.

Strategies for Reducing Debt Before Buying a Home

Tackling existing debt head-on is indispensable when eyeing homeownership. Prioritize high-interest debts first paying these off reduces overall interest paid and quickens the journey to becoming debt-free. Additionally, consider debt consolidation as a tool for managing multiple debts more efficiently.

Navigating the Arizona Real Estate Market

Current Market Trends in Arizona

The Arizona real estate market is currently a whirlwind of activity, characterized by competitive housing prices and fluctuating inventory levels. As more people move to the Grand Canyon State for its vibrant culture and economic opportunities, the demand for housing has surged, creating a seller's market.

Inventory levels in Arizona are struggling to keep up with the surge in demand, resulting in a significant increase in housing prices. Buyers are finding themselves in bidding wars, often paying above the asking price to secure a property. This trend is particularly noticeable in hotspots like Phoenix and Scottsdale.

Predictions for future market movements suggest that Arizona's real estate landscape will continue to be competitive. Factors such as interest rates, economic growth, and migration patterns will play critical roles. Potential buyers should stay informed and act swiftly when opportunities arise.

Finding Properties Eligible for Assistance Programs

For those seeking financial aid in purchasing a home, Arizona offers various assistance programs. To find properties eligible for these programs, its crucial to conduct thorough research and understand the specific criteria of each program.

Working with real estate agents who specialize in assisted sales can be incredibly beneficial. These professionals have a deep understanding of local assistance programs and can guide buyers toward properties that qualify for aid, streamlining the buying process.

- Research Local Programs: Start by researching state and municipal down payment assistance programs available in Arizona.

- Set Your Budget: Know your budget limits to focus your search on homes within your financial reach that qualify for assistance.

- Contact Housing Agencies: Get in touch with local housing agencies that can provide up-to-date information about eligible properties.

- Online Portals: Utilize online real estate portals that filter listings based on program eligibility requirements.

- Consult Experts: Engage with mortgage lenders or financial advisors familiar with assistance programs to help navigate eligibility details.

- Maintain Flexibility: Be open to exploring different areas and property types that may offer better eligibility for assistance programs.

The Impact of Location on Down Payment Assistance

The availability and amount of down payment assistance in Arizona can dramatically vary based on location. Urban areas tend to have more robust programs designed to attract buyers to denser communities, while rural areas might offer incentives aimed at encouraging development or occupancy.

In urban settings like Phoenix or Tucson, buyers might find additional incentives such as tax abatements or grants for choosing certain neighborhoods. Conversely, rural areas may present opportunities through USDA loans or other region-specific initiatives, which can significantly affect the affordability of homes.

Legal and Regulatory Aspects of Down Payment Assistance

Understanding the Legal Framework of Assistance Programs

Down payment assistance programs are governed by a myriad of laws designed to ensure fair access and prevent fraud. It is crucial for both buyers and lenders to understand the legal framework that underpins these programs. This includes knowing the source of funding, eligibility requirements, and the terms of repayment if applicable.

Federal vs. State Program Regulations

Differentiating between federal and state down payment assistance programs is vital as each comes with its own set of rules. Federal programs often have broad qualification criteria, while state programs might offer more tailored solutions but with more stringent requirements. Always check for recent changes in regulations to stay compliant.

Compliance with Housing Laws and Standards

Adherence to housing laws such as the Fair Housing Act is non-negotiable when participating in down payment assistance programs. These laws are in place to prevent discrimination and promote equal housing opportunities. Buyers should ensure that their program adheres to these standards to avoid legal pitfalls.

The Closing Process with Down Payment Assistance

Steps Involved in Closing a Home Sale with Assistance

The closing process can be complex, especially when incorporating down payment assistance. This typically involves additional paperwork and verification steps to ensure funds are used appropriately. Buyers should be prepared for a slightly longer closing timeline when utilizing these funds.

Role of Legal Professionals in the Closing Process

- Title Search: Legal professionals conduct a title search to ensure there are no outstanding liens or disputes on the property.

- Escrow Account Management: They manage an escrow account where the down payment funds are held until closing.

- Closing Document Preparation: Preparing all necessary documents, ensuring they reflect the terms of the down payment assistance correctly.

- Legal Guidance: Offering legal guidance throughout the process, particularly if issues arise with compliance or fund disbursement.

Tax Implications of Receiving Down Payment Help

Tax Benefits for Home Buyers

Homebuyers may enjoy certain tax benefits when they receive down payment assistance. For example, portions of their mortgage interest and property taxes may be deductible. It's essential for buyers to consult with a tax professional to fully understand what benefits apply to their situation.

Reporting Assistance on Tax Returns

The manner in which down payment assistance is reported on tax returns can significantly impact a buyer's tax obligations. Some forms of assistance may be considered taxable income, while others could qualify for tax-exempt status. Accurate reporting is key to avoiding penalties or audits from tax authorities.

Preparing for Long-Term Homeownership Success

Maintaining Your Home Investment

Ensuring the longevity of your home requires consistent upkeep. Regular maintenance not only preserves your home's value but also prevents costly repairs down the line. It's crucial to address issues when they're small, which can save you a bundle and keep your investment secure.

Being proactive about home care means scheduling seasonal inspections for critical systems such as heating and cooling, roofing, and plumbing. This approach to preventive maintenance will keep your home running smoothly and efficiently, providing peace of mind for years to come.

Regular Home Maintenance Tips

- Inspect roofing: Check for damaged shingles and leaks twice a year.

- Clean gutters: Remove debris to prevent water damage and pests.

- Service HVAC systems: Annual servicing can extend the life of your heating and cooling systems.

- Check seals: Window and door seals should be inspected annually to maintain energy efficiency.

Planning for Future Home Improvements

Anticipating future renovations can significantly enhance your property's value over time. Set aside a budget for upgrades that modernize your space or improve energy efficiency. Research shows that kitchen and bathroom remodels often yield the highest return on investment.

Beyond aesthetic updates, consider improvements that bolster safety and accessibilityespecially if you plan to age in place. Upgrades like these not only make your home more comfortable but can also attract a broader range of buyers if you decide to sell.

Refinancing and Managing Your Mortgage

The mortgage landscape can shift, presenting opportunities to reduce your interest rate or adjust monthly payments. Staying informed about refinancing options helps you manage your mortgage effectively, potentially saving thousands over the life of your loan.

Mortgage management is a strategic component of homeownership. Regularly reviewing your mortgage terms and staying abreast of market trends ensures you're always in the best possible financial position with regard to your home loan.

When to Consider Refinancing

You might consider refinancing when interest rates drop significantly below your current rate or if there's been a change in your credit score or financial situation. Refinancing can lead to lower payments, shorter loan terms, or the ability to tap into home equity for large expenses.

Bear in mind that refinancing isn't free; closing costs can add up. It's essential to calculate whether potential savings outweigh these fees before proceeding. A trusted financial advisor can help guide this decision-making process.

Options for Mortgage Adjustment

If refinancing isn't right for you, other mortgage adjustments may be beneficial. Loan modifications, for instance, can alter the terms of your mortgage without a full refinancepotentially lowering interest rates or extending the loan period to reduce monthly payments.

Another option could be switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing predictability in payments. Discussing these options with a lender can reveal solutions tailored to your unique financial situation.

Community Resources and Ongoing Support

Tapping into local resources can greatly enhance your homeownership experience. Many communities offer workshops and services specifically designed to support homeowners in maintaining their investment and navigating financial decisions related to their property.

Leveraging these resources not only strengthens individual homeownership success but also contributes to community stability by fostering informed, engaged residents who take pride in their homes and neighborhoods.

Homeownership Education Workshops

Educational workshops are invaluable tools for both new and seasoned homeowners alike. These programs cover a range of topics including basic home maintenance, financial planning, disaster preparedness, and even how to maximize the benefits of tax deductions for homeowners.