Down payment assistance for conventional loan Quiz

Test Your Knowledge

Question of

Understanding Down Payment Assistance

Eligibility Criteria for Assistance Programs

- Income Level Requirements

- Credit Score Benchmarks

- First-Time Homebuyer Status

Types of Down Payment Assistance

- Grants and Forgivable Loans

- Deferred-Payment Loans

- Matched Savings Programs

The Application Process for Assistance

- Gathering Necessary Documentation

- Completing Application Forms

- Submission Deadlines and Timelines

Conventional Loans Explained

What is a Conventional Loan?

Definition and Key Features

A conventional loan is a type of mortgage that is not insured or guaranteed by the federal government. It is typically fixed in its terms and rate, and is issued by private lenders.

Conforming vs. Non-Conforming Loans

Conventional loans can be divided into conforming and non-conforming loans. Conforming loans meet the guidelines set by Fannie Mae and Freddie Mac, while non-conforming loans do not.

Loan Limits

The loan limits for conventional loans vary depending on whether the loan is conforming or non-conforming. Conforming loan limits are set annually by the Federal Housing Finance Agency (FHFA).

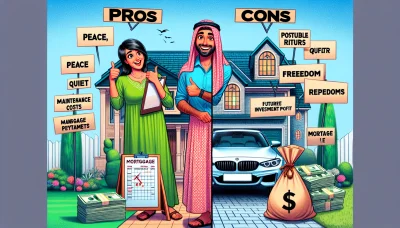

Pros and Cons of Conventional Loans

Interest Rates and Terms

Conventional loans often come with competitive interest rates and various term lengths, making them appealing to a broad range of borrowers.

Private Mortgage Insurance (PMI)

Borrowers who put down less than 20% on a conventional loan typically have to pay PMI until they achieve 20% equity in their home.

Flexibility in Property Types

Conventional loans can be used for a variety of property types, including primary residences, second homes, and investment properties.

Preparing for a Conventional Loan Application

Assessing Your Financial Health

Before applying for a conventional loan, it's important to review your finances, including your income, debts, and expenses.

Improving Your Credit Score

A higher credit score can improve your chances of being approved for a conventional loan and securing a lower interest rate. Taking steps to improve your credit score is crucial.

Saving for a Down Payment

While it's possible to obtain a conventional loan with a down payment as low as 3%, saving for a larger down payment can reduce your PMI and improve your loan terms.

How Down Payment Assistance Works with Conventional Loans

Integration of Assistance Programs and Loans

- Lender Participation Requirements: Lenders must meet specific criteria to offer down payment assistance alongside conventional loans, ensuring they can effectively integrate both financial aids.

- Coordination with Government-Sponsored Enterprises: Effective collaboration with entities like Fannie Mae and Freddie Mac is crucial to align assistance programs with conventional loan standards.

- Impact on Loan Terms and Conditions: The inclusion of down payment assistance can influence the terms, interest rates, and conditions of the conventional loan.

Calculating the Total Loan Amount with Assistance

- Determining the Down Payment Percentage: The amount of assistance received directly affects the down payment percentage, potentially lowering the upfront cost for the borrower.

- Understanding Loan-to-Value Ratio: Down payment assistance plays a critical role in determining the loan-to-value ratio, impacting loan approval and terms.

- Estimating Closing Costs and Fees: Borrowers must account for closing costs and fees, which can sometimes be covered or reduced through assistance programs.

Repayment Structure for Combined Assistance and Loans

- Monthly Payment Breakdown: The integration of down payment assistance affects the monthly mortgage payment, potentially making homeownership more accessible.

- Long-Term Financial Planning: Borrowers should consider how the assistance and loan terms fit into their broader financial goals and planning.

- Assistance Program Recapture Rules: Some programs may have recapture provisions that require repayment of the assistance under certain conditions, impacting the borrower's financial obligations.

Finding Down Payment Assistance Programs

-

Federal and State Assistance Options

- HUD's Homeownership Programs

- State-Specific Housing Finance Agencies

- Veterans Affairs (VA) Home Loan Program

-

Local and Community-Based Initiatives

- Non-Profit Organizations' Contributions

- Employer-Assisted Housing Benefits

- Community Seconds Programs

-

Researching and Comparing Programs

- Utilizing Online Databases and Resources

- Attending Homebuyer Education Workshops

- Consulting with Real Estate Professionals

The Role of Credit in Securing Assistance

Understanding Credit Score Implications

- Minimum Score Requirements for Programs

- How Credit Affects Interest Rates

- Strategies for Credit Score Improvement

Managing Debt-to-Income Ratio (DTI)

- Calculating Your DTI Ratio

- Lowering DTI Before Applying for Assistance

- DTI Limits for Various Assistance Programs

Building a Strong Credit Profile

- Regularly Monitoring Credit Reports

- Addressing Errors and Discrepancies

- Establishing a History of Timely Payments

Preparing for Homeownership with Down Payment Assistance

-

Budgeting for Homeownership Costs

- Estimating Monthly Mortgage Payments

- Accounting for Maintenance and Repairs

- Planning for Property Taxes and Insurance

-

Navigating the Home Buying Process

- Choosing the Right Real Estate Agent

- Identifying Suitable Properties

- Making an Offer and Negotiating Terms

-

Long-Term Homeownership Strategies

- Building Home Equity

- Refinancing Options

- Selling and Upgrading Considerations

Overcoming Common Challenges in Down Payment Assistance

-

Addressing Limited Funding Availability

- Exploring Multiple Program Options

- Timing Applications Strategically

- Preparing for Waitlists or Lotteries

-

Navigating Complex Program Requirements

- Understanding Residency Obligations

- Complying with Property Standards

- Fulfilling Homebuyer Education Mandates

-

Ensuring Compliance Post-Purchase

- Maintaining Eligibility Status

- Meeting Occupancy Requirements

- Handling Recapture Tax Implications